If you are an eager budget beaver like me then you’ll come at a point in your budgeting life where you will soon discover that the free or paid versions of organising your money just doesn’t quite cut the mustard.

I have used many free and paid version apps that try to help me keep on top of my money, but there will always be some feature that I need that has been found lacking.

And I’d like to say straight off the bat that QuickBooks isn’t a perfect solution .

One aspect that you should be very careful of when signing up is to start on the lowest plan . If you have to upgrade because a feature is needed it is much easier going up than it is going down, unless you enjoy travelling down to middle earth, defeating all manner of orcs and dragons, and returning back home before dinner.

Therefore, start on the lowest plan and ignore whatever crazy discount they currently have on display. Just focus on the standard price as if you end up using this amazing product for a long while this will be what you need to prepare yourself for with each month.

Ok, so now you’ve heeded the warning, let’s see how Quickbooks can enhance your personal finances.

Where do other personal finance apps fall short?

Let’s face it most personal finance apps in this space are good at generally doing a couple of things well:

- Getting your bank data

- Automatically categorising your data into categories

- Providing nice shiny graphs

- Some might help with forecasting

- Some might help with creating budget targets

But when it comes to managing your finances there are a few more things that are needed where most of these personal finance apps fall short .

Where Quickbooks Online shines

Being a husband, a dad, a full time employee, involved in church ministries and getting a wink or two of sleep in, as you can imagine I don’t have a lot of spare time.

Therefore, my needs when searching for something to help organise and manage my finances can be boiled down to these core requirements:

- Easy to access

- Easy to annotate transactions

- Easy to do non-cash transactions

- Easy to categorise, sub-categorise, sub-sub-categorise (etc)

- Easy to check

- Easy to report on cash and financial position

My requirements aren’t that sophisticated, I’m definitely easy to please, but it has been difficult trying to find a solution that can meet the majority of these requirements.

So how did Quickbooks Online stack up?

With my requirements in hand, here is how Quickbooks Online (QBO) has helped me to stay on top of our family finances:

1. Mobile, Desktop & Browser apps

You can access Quickbooks Online wherever you are

Accessing Quickbooks Online could never be easier. There is an easy to use mobile app for my iPhone, there’s also a macOS desktop app that I can run from my Macbook Pro and I can also access my account anywhere from within any standard browser window.

What’s more I can also login using my Gmail account!

2. Capture receipts

From within the mobile app I can take photos of receipts and have them automatically uploaded to the transaction.

From within the desktop and browser windows I can similarly attach PDFs and other documents helpful in providing further detail about the transaction.

3. Annotate notes to your transactions

If assigning a transaction to a category, or inserting attachments isn’t enough then you could always add more detail by writing text into the memo field.

You do have a limit of 4,000 characters, but I’ve never gotten close to this limit with any details I’ve written.

4. Creating journal transactions is a breeze

This is one very important feature lacking from most personal finance apps – the ability to insert non-cash transactions. As most personal finance apps rely solely on what they get from the bank feeds you provide, should you need to create a non-cash transaction, such as appreciation of an investment or depreciation of an asset, you can’t.

You would need to monitor this outside of the app which can be frustrating.

But with Quickbooks Online you can simply create a Journal transaction and if you know how to perform basic accounting transactions (i.e. you know your debits from your credits) then creating these transactions is a breeze.

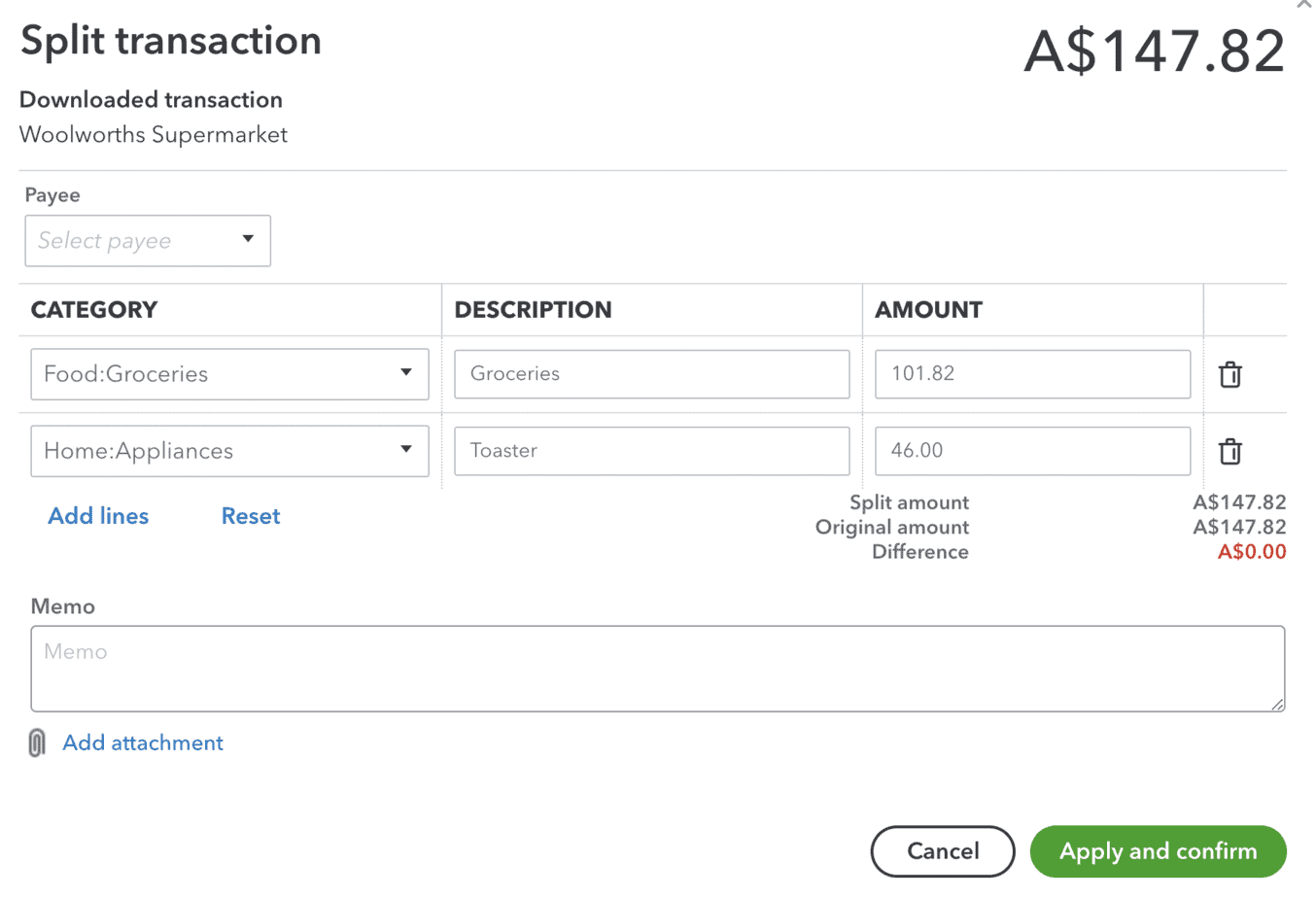

5. Split transactions into multiple lines

Another critical feature that some personal finance apps don’t quite get right, or that some make terribly difficult to do, is being able to split a transaction right then and there.

I shouldn’t have to navigate away from the bank feed transaction, create a journal, and then come back and match the transaction to my newly created journal.

Instead I want to be able to split a transaction right then and there and to be able to categorise each line individually.

Again, Quickbooks Online knocks this ability out of the park, making it easy to do and very user friendly.

6. Easily create sub-categories

When you’re organising your family finances you need to be able to separate out at least three different types of accounts: one for the husband, one the wife and then another for joint transactions.

For example, if I have an investment account in my personal name then I need to annotate this with my name. If I make any profits or losses from this investment then I need to assign these transactions to categories that are specific to me . This is just basic level tax.

Whereas if my wife and I have a joint savings account then I need to be able to create the account and similarly create an account labelled “ Joint – Interest Received “. This tells both me and my accountant that the interest earned here is split 50:50.

Therefore, I need something that can handle the sophistication family finances bring to the table. We need nested categories and we need categories specific to one individual and not the other, or to both.

Again, this all came down to how I designed the Chart of Accounts within Quickbooks Online and I found the import feature most impressive. I even had several edits and additions to make after import and these were just as easily handled.

I found it easy to import, create, modify and delete (make inactive) any of the accounts and it was all very easy to create sub-accounts and even sub-sub-accounts. I don’t think I was crazy enough to go a third level down.

7. Reconciling is a cinch

This is yet another massively needed feature that is found lacking in most personal finance apps these days.

How do you know if you’ve got all your transactions?

Or if the bank feed didn’t hiccup and double your transactions one day?

The only way to know is by reconciling your transactions in your system with the bank statement. Thankfully, with Quickbooks Online it’s extremely easy with their reconciliation feature to check your bank accounts, or other asset accounts (and credit card accounts) are reconciled too.

8. Connect to any bank

While most personal finance apps have this feature Quickbooks Online similarly matches the competition by connecting to your bank account and feeding data directly into the system awaiting your confirmation.

There’s a massive list of available banks and I didn’t have any difficulty finding the banks I use and connecting them.

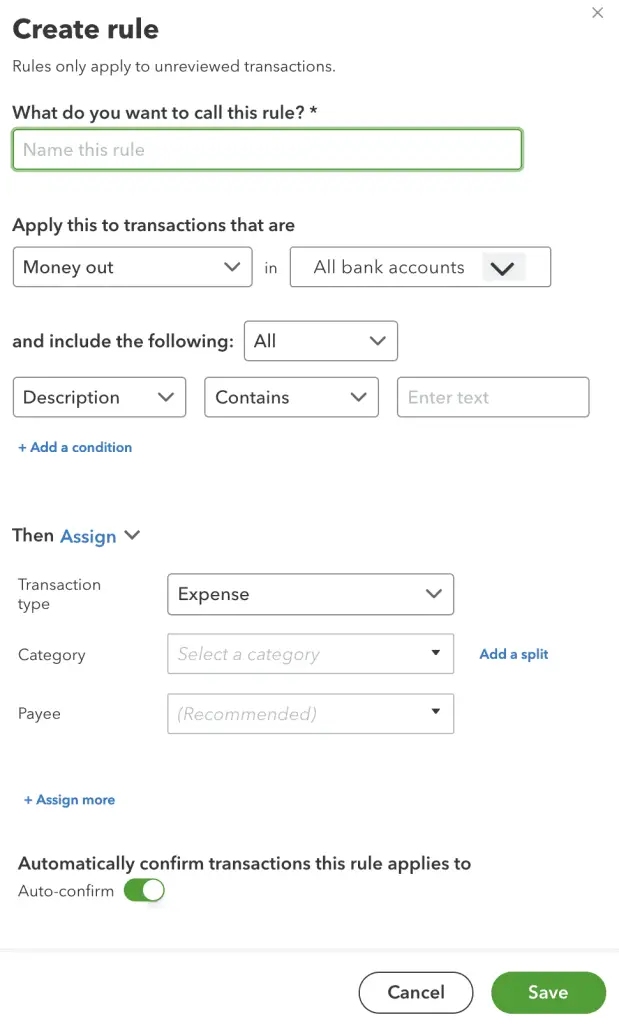

9. Automate transaction classification

Creating a rule within Quickbooks Online is very easy and yet very comprehensive.

Once you begin categorising your transactions it can be a pain to have to constantly categorise the same transactions over and over again.

Thankfully there’s an easy way to create bank rules and you can either be very detailed and specific on the conditions according to the criteria you set, or you can be quite liberal.

For example, I have a Groceries category where if the Bank Text contains “ALDI” it will automatically assign that transaction to that category. No need for me to do anything more, but confirm those transactions to that category when they come through.

10. Comparative reports

There are many reports available in Quickbooks Online that can easily provide the detail you’re looking for.

My basic uses only require the standard management reports of Profit & Loss (view income and expenses), Balance Sheet (view assets and liabilities) and Cash Flow (view money in and out).

However, my favourite types of reports are the comparison reports where you can compare how you are doing in one period against an older period in time.

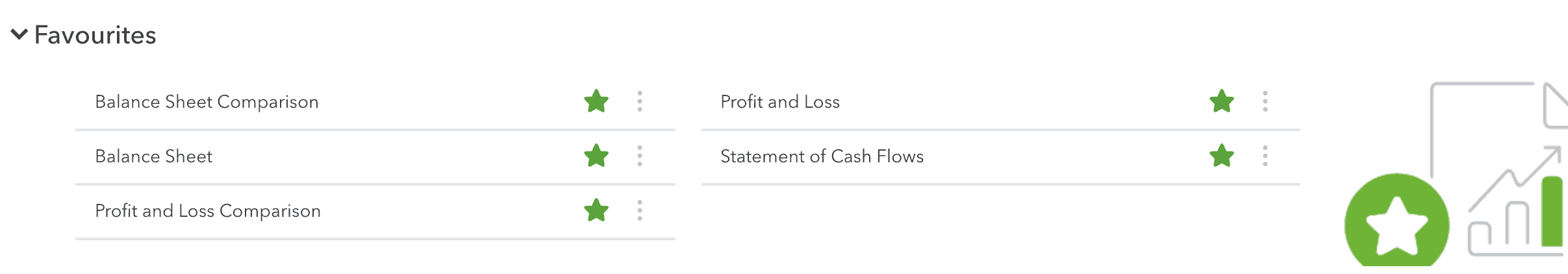

11. Favourite reports

An easy way to get to your favourite reports is by starring them.

One other nifty little feature I like in the reporting area is the ability to have all my favourite reports put into an accessible area so that I can find them easily without needing to hunt for them.

Conclusion

If you’re looking for a more complete suite of features when it comes to managing your personal finances then you must try for at least 1 month Quickbooks Online.

It certainly has helped my job as a father and husband to keep on track with how we are going with our spending and it certainly has helped in being able to find my tax deductions and taxable income at the end of the financial year.

When you’re ready to get started with your Quickbooks Online account, the first thing you’ll need to do is to import your chart of accounts which this helpful step-by-step guide will assist .