Where can you get a free 50/30/20 budget spreadsheet template?

Download a free 50/30/20 budget template to track how you’re spending should be allocated through the week, month or year with the flexible Google Sheet.

What is the 50/30/20 rule when it comes to budgeting?

The 50/30/20 rule is a simple budgeting method that allocates 50% of your take-home pay to needs, 30% to wants and the remaining 20% to savings or paying off debt (if any).

The rule provides a basic measure of how you allocate your outgoings.

What To Allocate To The 50%?

The outgoings that should be allocated to the 50% are the essentials of life: food, clothing and shelter.

For example, some items that can be classified within this section are rent and mortgage payments (place of residence not residential properties), groceries (not eating out), utilities (such as rates, water, electricity and gas), transport, clothing and insurances.

These are the basic necessities in life.

The danger with this is that it can be very easily to classify things that are necessities as necessities. Eating out at a restaurant is “food” but is not essential.

Other areas where this can be grey is in the area of giving. Is this an essential item? For some it is! If it is important for you to give then classify it as a need.

What To Classify In The 20%?

Once you have classified your needs and wants in the outgoings section then the remaining amount is classified as savings or paying off debts (such as credit card or car loans).

You could put additional payments toward your mortgage (loan on your place of residence) in this category too.

The purpose of this part of the construction of the 50 30 20 budget is to show how deliberate you are with saving your money. I know for myself that I think I save, but really all I’m doing is putting the money aside so that I can spend it on something big later!

How deliberate are you with saving or paying down your debts? This section might help to highlight whether you are deficient in this area.

Analyse Your 50 30 20 Budget

Now that you have some idea of how to classify your spending habits into either of the three buckets, it now comes down to entering this data into a spreadsheet to see how you’re currently faring.

The free 50 30 20 budget template spreadsheet below helps in a variety of ways and here’s how you can get the best out of it:

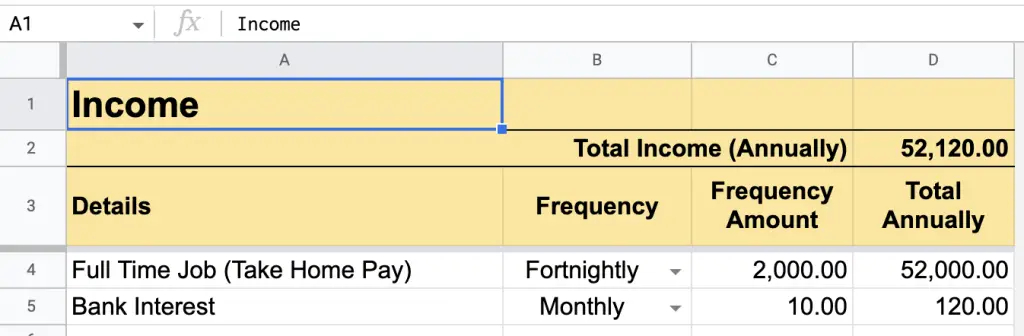

1. Enter All Your Earnings

First, enter your after-tax earnings on the Income sheet. This is the actual amount of money that lands in your bank account that you have complete discretion on. If you are a sole trader, then you would need to take out any taxes that need to be paid to the government.

The Income sheet should be the easiest to complete and the structure of the Income sheet is that it allows you to enter a detail as a prompt to help provide information of your earnings and enables you to focus on when you receive this amount.

If you get paid fortnightly, then you can enter the regular amount you get paid per fortnight by entering the frequency as Fortnightly and then the amount you get paid at that frequency, say $2,000. You can do this for the other types of income you earn as well, such as bank interest (for example).

Once you’ve completed the Income side of things, the next sheet Outgoings will list all the payments you make from your bank account.

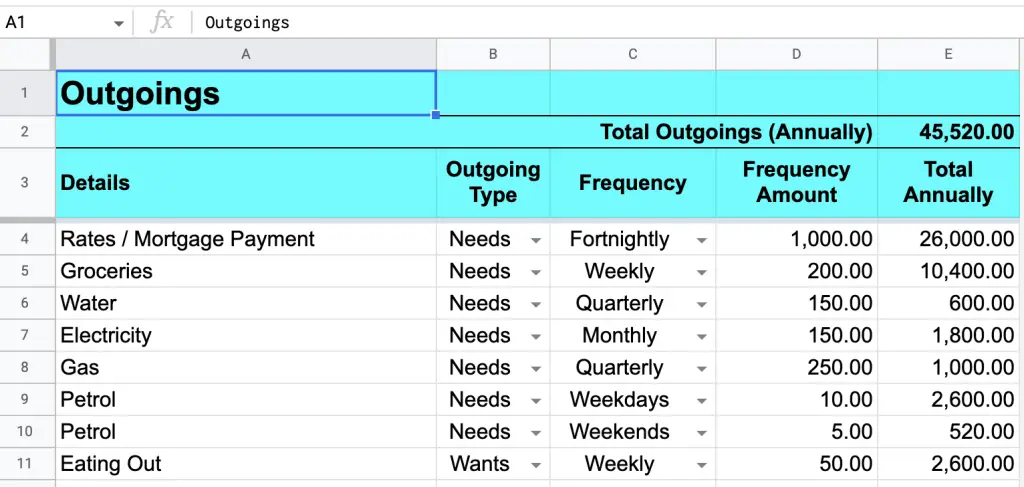

2. Enter All Your Outgoings

The hardest step is completing the Outgoings sheet. The reason why it is the hardest is that it can be difficult to remember all the payments that are made throughout the year as some payments are seasonal whereas others are regular.

Not only will there be difficulty in remembering when outgoings occur, but should you remember the next hardest part is classifying the payment as being a need, want or savings?

I’d encourage you to just try and remember as many of your outgoings as you can initially and to have a best guess as to the classification of whether something is a need, want or saving. Things can always be tweaked and changed later, the important thing is to get the exercise done so that you can see your spending characteristics.

3. Check Report

Once you’ve completely entered all the Income and Outgoings entries in the spreadsheet you can view how you fare by analysing the Report sheet.

This sheet will show you according to the Report Frequency how your Income is distributed amongst Needs, Wants and Savings .

The first column labelled will show you how your budget looks according to the classifications entered into the Outgoings sheet. The second column lists the 50-30-20 ratios for each category, and the third column multiplies the ratios by the total income to give you a projected spending amount according to the Report Frequency .

Finally, the Variance column helps to show whether your budget totals are over the 50-30-20 budget ratio (negative number) or under the 50-30-20 budget split (positive number).

Summary

The 50-30-20 budget template is a great way to get an idea of how you’re spending your money. By entering your income and outgoings into the template, you can see where you need to make changes in order to stay within the 50-30-20 budget ratio.

The Report section of the spreadsheet will show you how your budget looks according to the classifications entered into the Outgoings sheet, as well as how your Income is distributed amongst Needs, Wants and Savings.

This basic form of budgeting can be a great way to start seeing changes you need to make to your spending habits.