Since 2015, my wife and I have been using the wonderful associate lease arrangement for the two cars we’ve owned. We have experienced both fully maintained associate leases and novated-type associate lease arrangements and have had multiple arrangements span from as little as 1 year to as much as 5 years.

The objective of this article is to share my experiences with the associate lease, and this might help prompt questions you might have with your professional financial adviser or accountant on whether this set-up may benefit you.

I merely provide only anecdotal evidence here and answers to questions I have asked. Things change, so be sure to do your own research.

What is an Associate Lease?

An associate lease is an agreement between an employee’s employer and an employee’s associate (usually a spouse). The associate owns the car and leases it to the employer, and a portion of the employee’s salary is packaged for the lease of the car.

History of Associate Leases

The earliest mention of associate leases outside the Fringe Benefits Tax Assessment Act 1986 is found as far back as November 1988 when the ATO published a ruling regarding advertising that offered “a company car plan” that would beat fringe benefits tax.

The ruling IT 2509 mentions a few interesting concepts about the associate leasing structure:

- Item 10 in the ruling speaks of the tax implications of the associate who is both a party to the finance lease (the lease of the newly acquired car from the car dealer) and the sublease (the leasing of the car to the employee’s employer);

- Item 28 in the ruling provides an example of how close the relationship between the associate, and the employee is by giving an example, “(i.e. a family member, usually the spouse)”.

- The same item also describes the income tax implications of the arrangement for the spouse where the rental charges that the employer is paying will be “assessable income”, and where the employer is reimbursing “car expenses paid” the associate cannot claim those expenses as deductions.

- Item 29 also highlights a point that the associate would need to be aware of when it comes to selling the car: the profit made on the sale of the car would also be included as assessable income. If the associate has been depreciating the car using the prime cost method and sells the car then the difference between the sale price, and the depreciated value of the car is to be considered profit.

Using a very simple example to illustrate this last point above: if I have a 30,000 car and I depreciate it using the diminishing value method, after the first year 25% of the value has depreciated, meaning its asset value is 22,500. If you sell the car for 25,000 you have to pay income tax on the difference, being 2,500.

So as we can see from the above detailed ruling the arrangement of the associate lease for a car to the employer had been known as far back as 1988 , and what we have also learned in this ruling is the income tax implications of the arrangement for the associate – we’ve created a simple income tax return guide for an associate here .

Types of Associate Leases

There are two main flavours of associate lease arrangements, and these are known as:

- Fully maintained novated lease

- Fully maintained operating lease

Fully Maintained Novated Lease

This arrangement is the exact same as a novated lease with the only difference being the associate receives the lease payments (instead of the financier).

Novated Lease Parties

A novated lease arrangement involves several parties:

- Salary Packaging Provider

- Financier

- Employee

- Employer

The role of the Salary Packaging Provider is to be the distributor of your pre-tax salary to the financier and to your running cost fund. This means the Salary Packaging Provider helps to make the necessary leasing payments to the financier and helps to manage your running cost expenses (such as a fuel card).

The employer in this arrangement agrees to novate the lease payments by using a portion of the employee’s gross salary.

Finally, the employer withholds a portion of the employee’s salary to pay for the Fringe Benefits Tax liability (E) that the employer will incur when the Fringe Benefits Tax return has been lodged after March each year.

Therefore, in a fully maintained novated lease involving an associate of the employee, you would substitute the financier with the associate . Just as the financier receives payment for the lease of the car, so too does the associate.

Fully Maintained Operating Lease

This arrangement is similar to a fully maintained novated lease arrangement, however, instead of the Salary Packaging Provider helping to manage the running costs of the vehicle, it is managed by the associate.

A simple comparison table showing the differences between the two types of associate lease arrangements can be summarised as follows here:

| Detail | FM Novated Lease | FM Operating Lease |

|---|---|---|

| Management of Running Costs (eg. Fuel cards) | Salary Packaging Provider | Associate |

| Management of FBT Provision | Salary Packaging Provider | Employer |

If your employer uses the services of a salary packaging provider you’ll soon discover salary packaging providers do not provide the ability to salary package a fully maintained operating lease. By exploring the above table you can begin to understand why – there’s no need for them, and therefore they cannot make any money from the arrangement (unless they charge an upfront establishment fee).

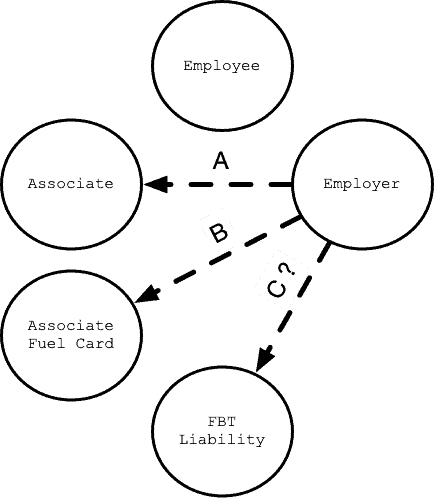

Here’s a diagram showing the fully maintained operating lease arrangement:

So in our diagram above the employer enters into a lease arrangement with the associate for use of the car and makes pre-tax payments of the employee’s salary to the associate (A). The fuel card is also in the name of the associate (not the employee), and the employer makes pre-tax payments to this card which the employee can use to help with paying for running costs (B).

Lastly there may be a Fringe Benefits Tax liability which the employer can withhold from the employee’s salary (C ?).

Benefits of Associate Lease Arrangements

So instead of the employer making lease payments to pay off the car to the financier, the employer is making lease payments to an associate for use of their existing car. The associate owns the car (a very important point), and the associate may have used whatever means necessary to acquire the car (cash or loan).

Obviously the biggest benefit of any associate lease arrangement is the ability to pay for running costs pre-tax and to derive an income from a family asset.

This helps with family cash flow and can provide an additional passive income for the associate.

Biggest Benefit of Fully Maintained Operating Lease

The biggest benefit of the fully maintained operating lease over the fully maintained lease is the associate can contribute the running costs they pay to the employee’s employer which can offset the fringe benefits tax incurred by the employer for the car.

This forwarding of receipts to the employer has been labelled as recipient payments (the term used in section 9(1) and 10(2) in the FBTAA).

By contributing the receipt running costs incurred to the employer these costs can reduce the taxable value of the car fringe benefit. A private tax ruling helps us to understand how the ATO thinks when presented with this very question .

While we cannot rely on private tax rulings, as they can be very specific to circumstances that may not wholly match our own, this private tax ruling shows how the ATO considers non-reimbursed running cost expenses incurred by the associate for the car – they can be used to reduce the taxable value of the car fringe benefit!

Gotchas with Fully Maintained Operating Lease

There are three aspects to the fully maintained operating lease that you need to be wary of before jumping into this type of arrangement:

- Ensure you’ve got the correct lease set up

- Ensure you’ve packaged adequate FBT

- Ensure you’ve covered all running costs appropriately

Is it a Fully Maintained Operating Lease?

Its vitally important for a fully maintained operating lease to be set up correctly . You’ll know it’s a proper operating lease when you see the actual phrase operating lease emblazoned on the lease and in the terms of the lease.

You’ll find when speaking to salary packaging providers they may sometimes think they are offering a fully maintained operating lease, when in fact they are not, and do not understand the difference between the two types.

Now you know.

Have You Salary Packaged Enough FBT?

While the associate is paying for the running costs of the vehicle and applying these costs as “recipient payments” to the employer there may still be an FBT liability if the taxable value of the car is greater than the recipient payments.

For example, if the base value of a car were 30,000 and the Statutory Fraction Method was to be applied, the fringe benefits taxable value would be $30,000 times 20% = $6,000. If the total recipient payments are less than 6,000 for the FBT year then there will be an FBT liability on this shortfall.

Therefore, a portion of pre-tax salary needs to be provisioned by the employee to the employer to help cover any FBT liability. If there doesn’t end up being any FBT liability the employee may elect to roll the balance over to subsequent years, or have the balance processed through payroll for which PAYG tax would be withheld.

Another similar issue to this arrangement is if the associate does not provide the recipient payments during or at the end of the FBT year. It may be wise to provision for the full amount of FBT from the employee’s salary to help cover for the lack of recipient payments provided at the end of the FBT year, and should they be provided then the employer can pay the provision as normal salary back to the employee or have the FBT provision rolled over to the next year.

Have You Asked For Appropriate Amount?

While you can’t be unreasonable in the leasing component of your associate lease arrangement, you may want to ensure you’ve correctly calculated and provided for enough of the running costs of your car.

If you fail to adequately cover enough of the running costs throughout the life of the lease arrangement you will risk having to pay using your own money to fulfil the terms of the lease.

Just as a landlord with a fully maintained lease, charges a little more for a fully furnished house for all the necessary furniture and/or maintenance costs applied (eg. pool cleaning, garden upkeep, etc), in similar fashion so too are running costs of the car calculated and incorporated into the lease rental charge of the associate lease arrangement. There doesn’t need to be an itemisation of the rental charge, it is just provided as one amount, and the associate declares all this as income on their income tax return.

The associate simply assesses the risks, maintenance and upkeep of the car and embeds these amounts into a flat rental charge. No different to a landlord with a fully furnished and maintained apartment or house.

Therefore, if the clutch falls out or the head gasket blows on the car provided to the employer the associate will have to pay more than what they thought they would have from the arrangement. This is the downside to this arrangement as opposed to the fully maintained novated lease above.

Which associate lease arrangement works best?

So now for the big question:

Which arrangement works best under what circumstances?

Time for us to do some math.

There are only two numbers we really need to help us roughly calculate the implications of either arrangement, and the numbers needed are:

- The Base Value of the car (generally it’s market value); and

- The anticipated Running Costs of the car for the year (including GST)

If we apply the Statutory Formula Method to calculate the Taxable Value of the car (which starts the whole FBT liability calculation going) then we would arrive at the following formula regardless of methods used:

TV = BV \times 20\%

The only difference now is at what point one method outweighs the other. For the Reimbursement Method the formula on the net benefit would be the difference between the Taxable Value of the car, and the GST recovered from the employer, being represented as follows:

TV - \frac{RC}{11}

Or to wrap both formulas into one:

(BV \times 20\%) - \frac{RC}{11}

Whereas in the Fully Maintained Operating Lease the corresponding formula would look like so:

max( TV - RC, 0 )

Or as one formula with the Taxable Value included:

max( (BV \times 20\%) - RC, 0 )

Let’s test our formulas on a couple of examples. We’ll assume for our first example that the Base Value of the car is 30,000 and its subsequent Running Costs are 4,000 for the year.

| FM Operating Lease | FM Novated Lease |

|---|---|

| (30,000 \times 20\%) - 4,000 = max( 2,000, 0 ) = 2,000 | (30,000 \times 20\%) - \frac{4,000}{11} = 5,637 |

As these two solutions have shown it appears when the running costs are less than the Taxable Value it will be the Fully Maintained Operating Lease that would be best.

What if we had a cheaper car, and the same running costs? Let’s amend our Base Value down to 10,000.

| FM Operating Lease | FM Novated Lease |

|---|---|

| (10,000 \times 20\%) - 4,000 = max( -2,000, 0 ) = 0 | (10,000 \times 20\%) - \frac{4000}{11} = 1,637 |

Once again the Fully Maintained Operating Lease wins out because it helps to minimise or even eliminate the Taxable Value to zero , whereas the other method still leaves a Taxable Value amount which would then have FBT consequences.

If the employer were FBT exempt then it wouldn’t matter what the Taxable Value would be as the resulting liability would be zero ( up to a grossed up limit cap of $17,000 currently ), but for Rebatable and other employers we can see it can make a big difference.

Summary

As demonstrated in this article the associate lease is an excellent arrangement that employees can use to effectively salary sacrifice the running costs of an existing or new car owned by an associate (such as their spouse).

The two methods only differ with how the running costs of the car are to be applied – either reimbursed by the employer with the fully maintained novated lease, or fully paid by the associate with a fully maintained operating lease.

However, as mentioned in the article there are a couple of caveats for each method:

- The Fully Maintained Novated Lease arrangement may have the employer use the employee’s pre-tax salary to pay for the running costs of the car, but if these payments have not been consumed they would need to be returned and subsequently processed through payroll and have PAYG withheld (etc).

- The Fully Maintained Operating Lease arrangement may: leave the employer with an FBT liability if the employer has not been deducting a provision of FBT during the year, and the associate has not been forwarding receipts through to reduce the Taxable Value of the car.

Each method does have its administrative burden which could be outsourced to a salary packaging provider, but as mentioned previously, most salary packaging providers only offer the fully maintained novated lease.

Overall the associate lease is an effective arrangement and works well where the associate is not earning an income. For people not yet married, or where both husband and wife are working, a novated lease might be another alternative .