Is it possible to use the popular accounting software QuickBooks for managing your own personal finances?

Absolutely yes!

I have been using QuickBooks Online since 2015, and would highly recommend their service if you’re looking for a tool to help monitor, capture and record your bank, assets and loan transactions.

However, there is one major aspect I would caution you about when subscribing to their service which I didn’t heed when I first started and this caused major problems down the track for me.

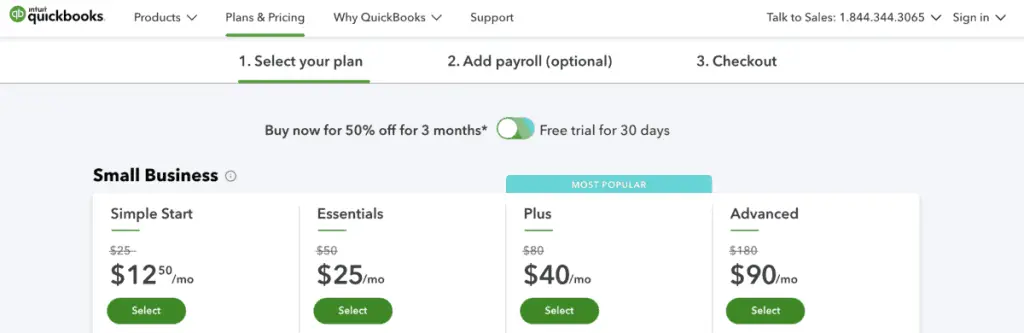

Tip #1 – Start On Lowest Plan

The biggest mistake I made when starting with QuickBooks was purchasing a subscription plan that I was not getting the value from.

Now you’d think this would be an easy adjustment – just downgrade to the next level, right?

Wrong.

You cannot downgrade plans.

Therefore, if you do want to downgrade its a case of exporting all your data and then importing it again.

Yes, it’s a pain and one that I got suckered in by with the marketing at the time. (I think they had something like a 70% off the original subscription price, and one of the top subscriptions was $10 per month for 12 months. It was great for 12 months, but a lot of the bells and whistles at the top tier I didn’t need, so when the standard price returned it was too much.)

Start with the lowest plan and upgrade when you really need the functionality, because it’s a pain when you have to go down the other way.

Tip #2 – Ignore Budget Feature

Somewhat related to the previous tip: I was able to test the budget feature during my initial 12 months when I started with QuickBooks Online, but found it rather useless for personal finance budgets.

Sure it tracks an account’s expenditure over the course of the next 12 months, but you have to key these projected balances and amounts of manually .

Ugh.

At least Xero provides the ability for users to import their budgets by a CSV file.

Unfortunately QuickBooks isn’t as intuitive with managing budgets, and there’s probably a good business case for why there’s no real need. People use spreadsheets or other means (such as an envelope system) to manage their finances and QuickBooks just tries to help by allowing you to enter that data.

Personally I manage my budget externally in a spreadsheet and should I want an historical report on my transactions I’ll run a report in QuickBooks.

Overall I’d skip any plans with a budget feature, at least, don’t think you’ll need it and purchase that plan.

Tip #3 – Direct Bank Feeds May Be Unsupported

While QuickBooks supports a multitude of banks you may find you’re personal savings account may not have a direct feed feature.

We have been with Macquarie Bank for a couple of years now and our personal joint account does not allow a direct feed. All this means is the connection between QuickBooks and your bank is through a provider rather than directly with the bank.

Again, you’ll still have your bank feed coming through, but there may be times (maybe once a year) where your bank feed my burp and end up doubling the transactions on the day. It’s a small annoyance.

Tip #4 – Create A Chart Of Accounts Most Meaningful To You

When you do create an account in QBO you will proceed through some steps to help guide you on the best types of accounts to start your Chart of Accounts with.

This is great if you have a business, but not so great if you want to put non-business accounts like: Groceries, Dentist, Pharmacy/Chemist, Children’s Tuition (etc).

Therefore, try to start with a blank Chart of Accounts or make as many as i s not needed inactive.

Conclusion

If you want to try QuickBooks to help manage your personal finances I highly encourage you to give it a go and try today.