CommSec Pocket makes investing into the ASX’s popular ETFs easy, repeatable and cheap. If you’re looking to get into the ETF market and want to dip your toe into the market by regularly (or ad-hoc) investing money into the top ETF’s trading on the ASX then look at CommSec Pocket as a platform.

How Much Does It Cost?

$2.00 per trade, or 0.02% of the trade size (whichever is greatest).

What ETF’s Can You Trade?

Currently there is only a limited quantity of ETF’s available to trade, but the range on offer covers the Australian market, top dividend Australian stocks (for those searching for yield), top global stocks, top stocks in emerging markets, top global healthcare stocks, top stocks who are sustainable leaders and top global tech stocks.

One of the ETF’s should cater to your ETF exposure needs!

More specifically the ETF’s on offer at CommSec Pocket are the following:

- IOZ ( iShares Core S&P/ASX 200 )

- SYI ( SPDR MSCI Australia High Dividend Yield Fund )

- IOO ( iShares Global 100 )

- IEM ( iShares MSCI Emerging Markets )

- IXJ ( iShares Global Healthcare )

- ETHI ( BetaShares Global Sustainability Leaders )

- NDQ ( BetaShares NASDAQ 100 )

How Do You Place A Trade?

Placing a trade on CommSec Pocket is very easy, however, there are a couple of things to mindful of. Firstly, you need to be able to have a CommSec account (if you already have one, as I did, then it’s an easy connection to your existing CommSec brokerage account). Secondly, you need to fund your CommSec brokerage account before you can place a trade.

If you have a bank account elsewhere and you want to take advantage of the regular nature of investing you will need to similarly set up the regular transfer of funds from your transactional bank account to your CommSec brokerage account. CommSec Pocket doesn’t yet allow for funds to be taken from an external bank account.

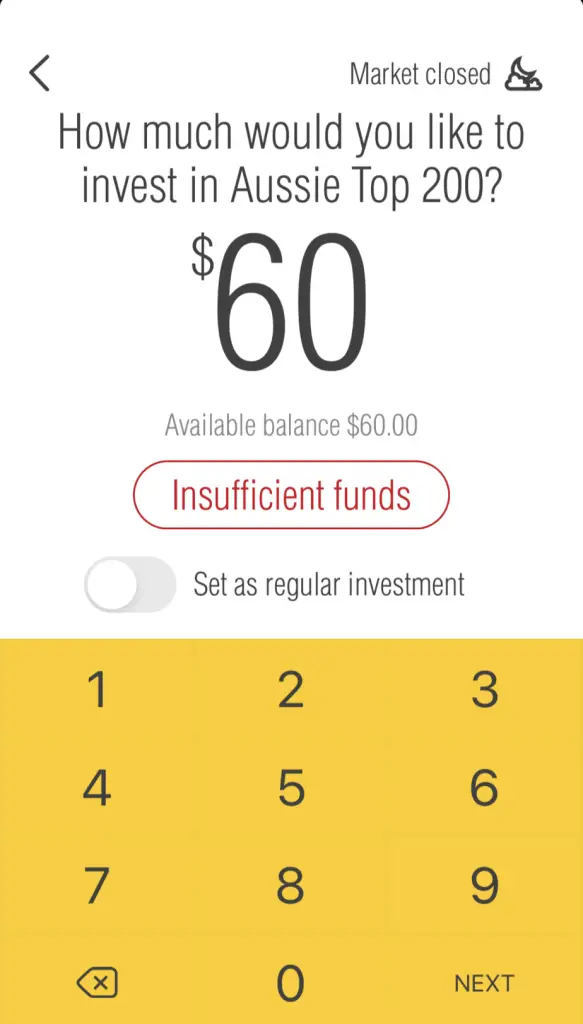

Thirdly, you need to make sure you have enough in your bank account to cover both the transaction you want to do, plus the brokerage cost, plus some volatility.

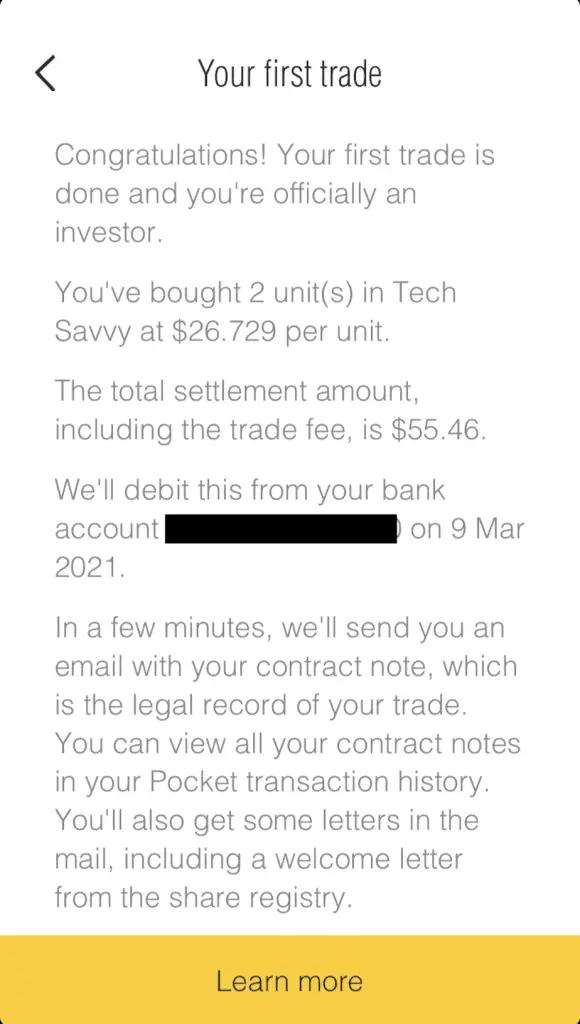

Also, the quantity of ETF’s you need to buy needs to exceed $50. Therefore, if you’re looking to purchase an ETF and its last price is $27.50, you will be purchasing a minimum of 2 of these for a total cost of $55.00. If an ETF is priced at $42.00 then you will be purchasing a minimum of 2 for a total cost of $84.00.

Here’s an example illustrating the point where you need to factor in volatility to place a trade. Here I was trying to purchase 2 IOZ ETF stocks and I had $60.00 in the account, yet the last trade price of the ETF was $27.88, therefore, I thought the minimum needed to trade this would have been $57.76 (includes brokerage). However, I found I couldn’t place the trade, as seen here:

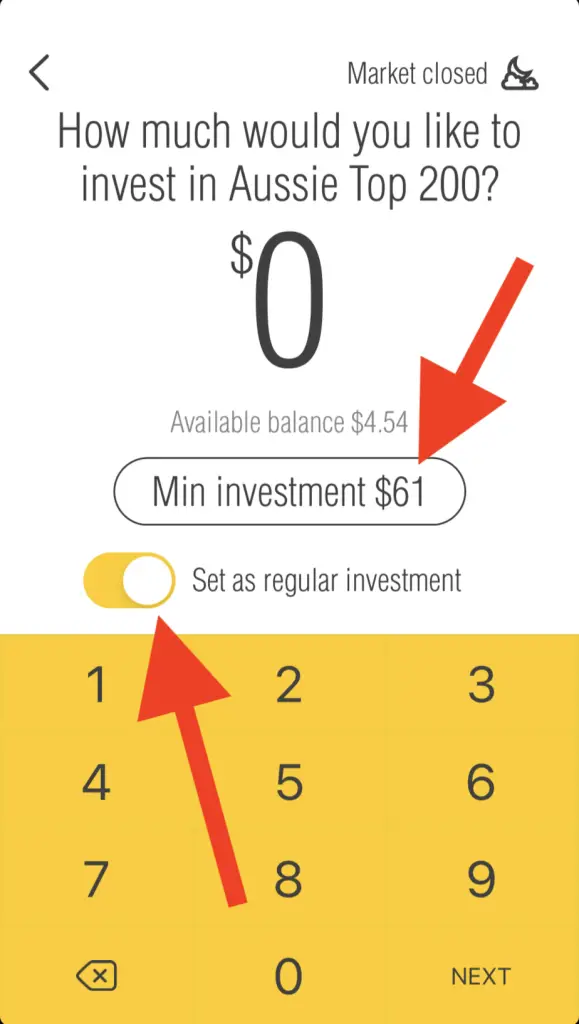

You can find out what the minimum amount to invest would be, all you have to do is flick the Set as regular investment to on and it will display this amount for you, as seen here:

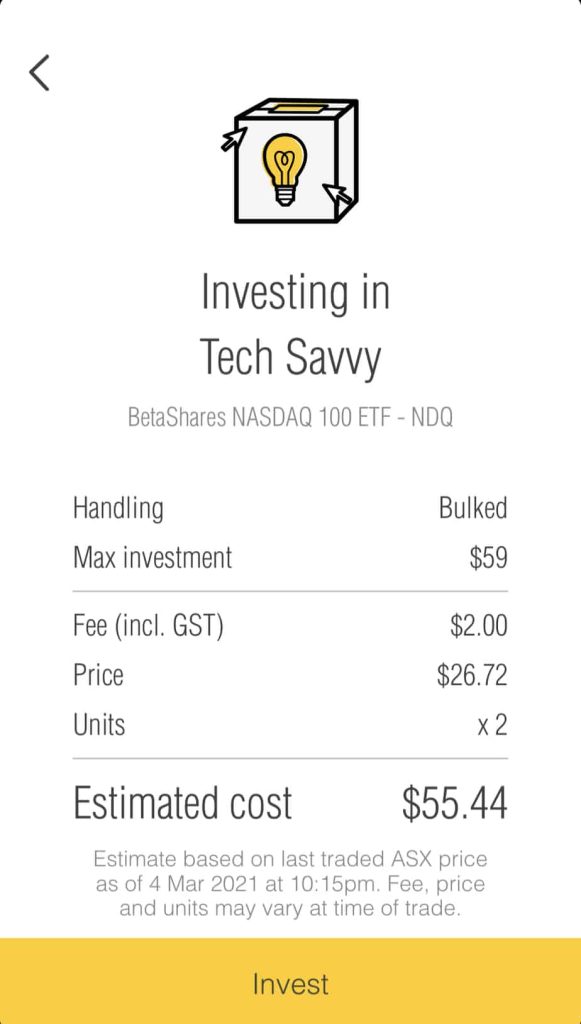

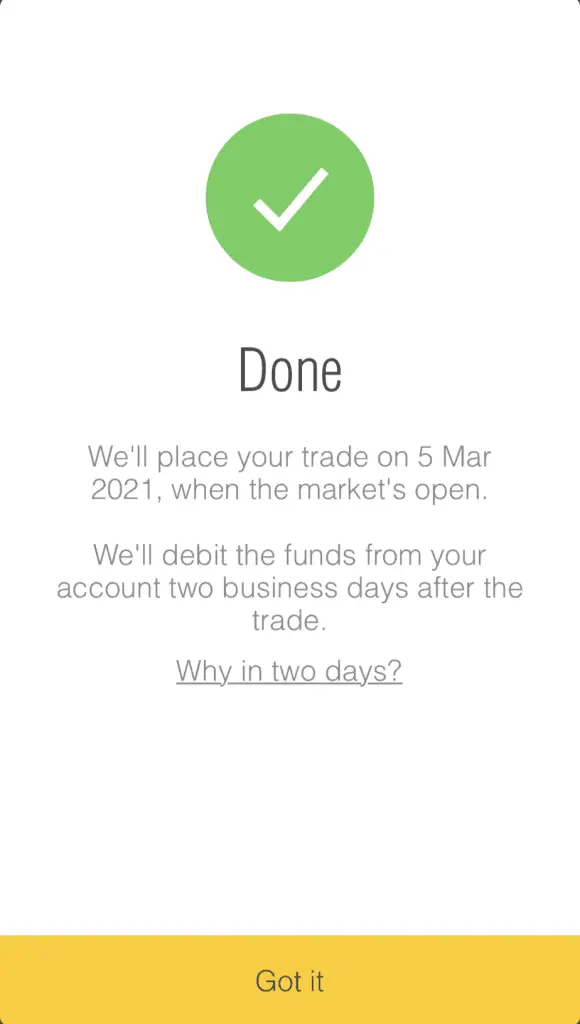

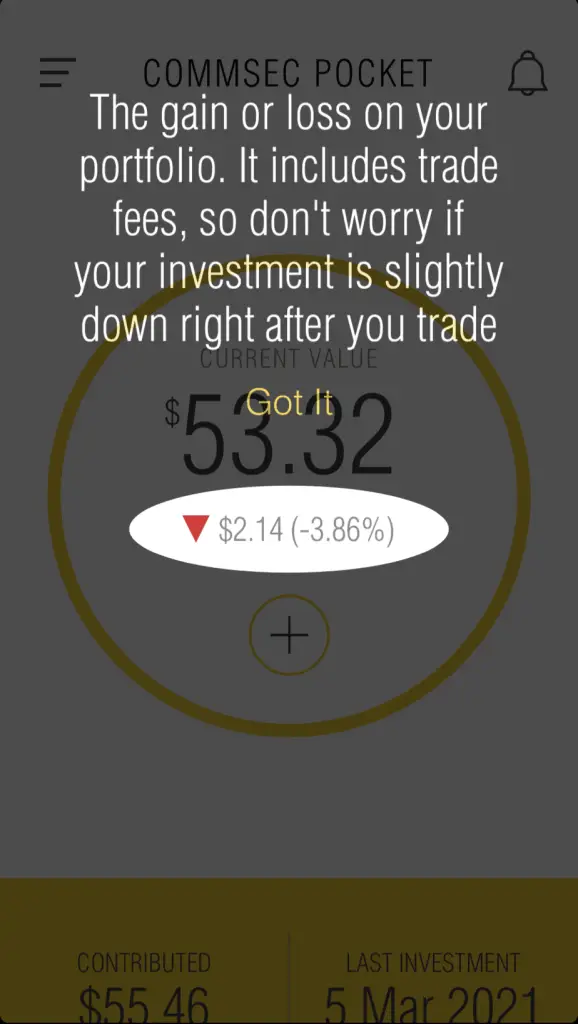

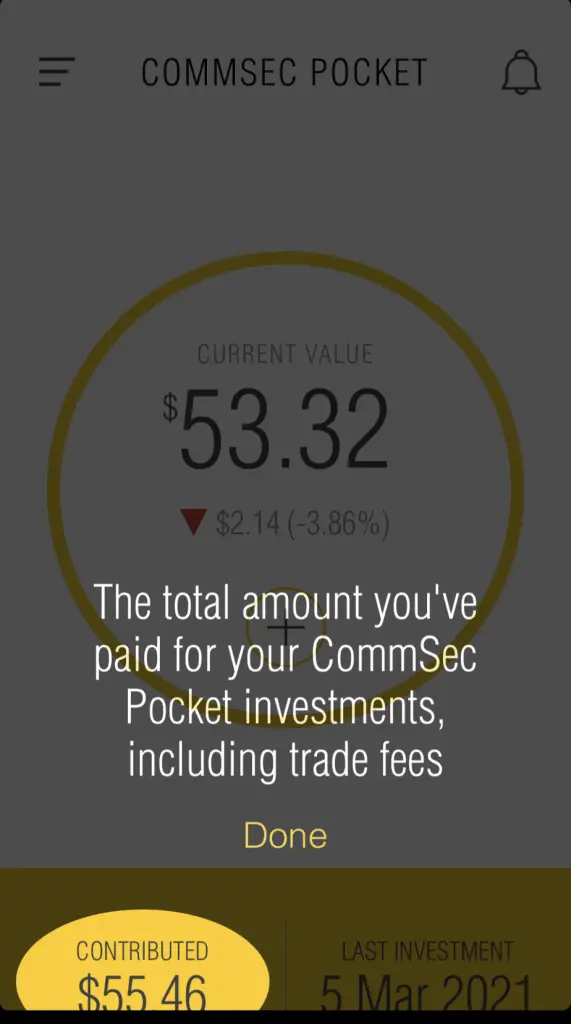

Anyway, once you’re successfully able to invest you’ll be presented with the following screens:

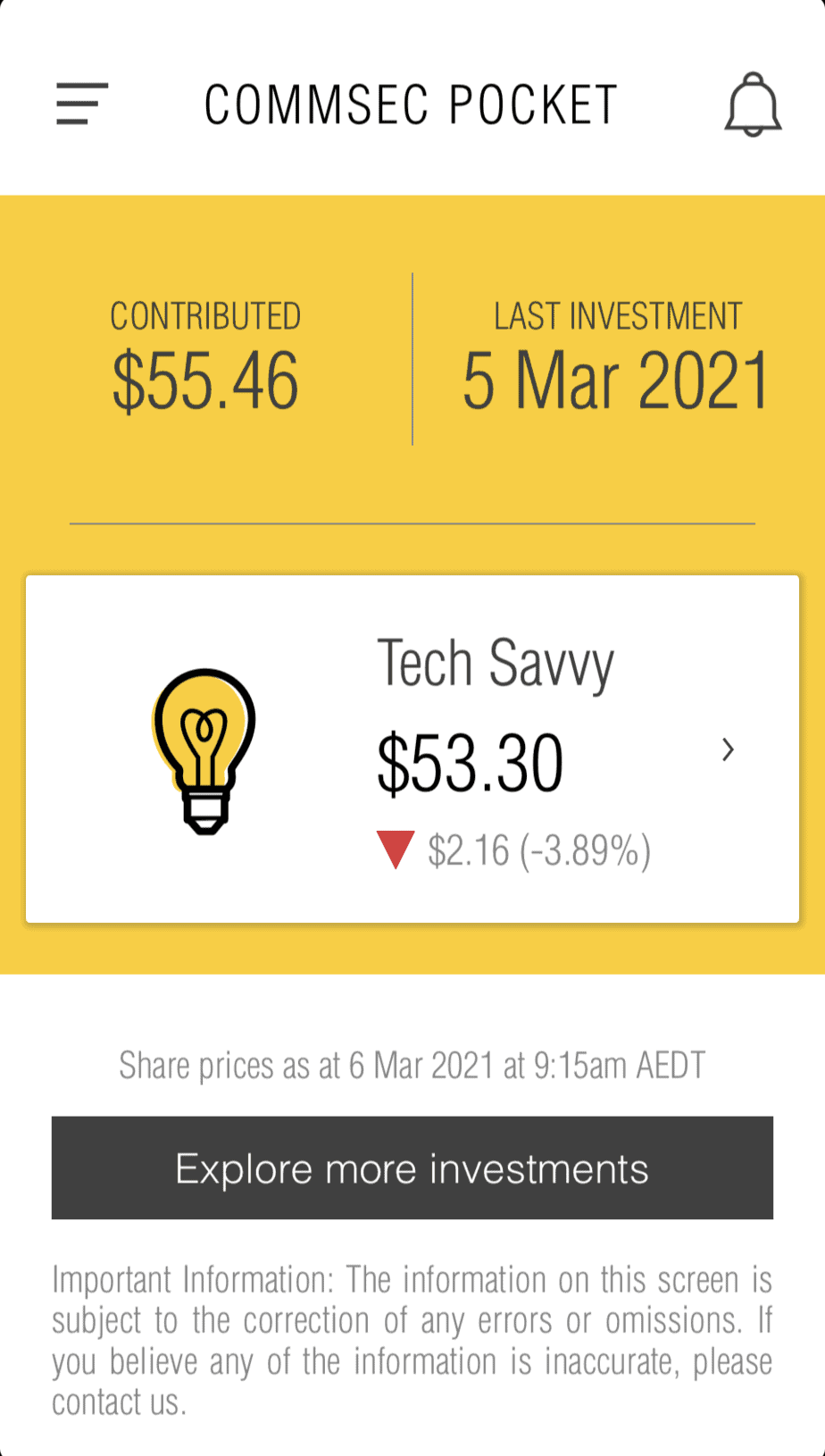

So as you can see CommSec Pocket helps to educate you in the app, and at the same time keep everything simple. Once you’ve placed your first trade you’ll begin to see values populate the interface of the app to help show how things are going.

As you progress through time, you’ll be able to scroll down and see a list of all the ETF’s you have invested in.

How Does CommSec Pocket Make Money?

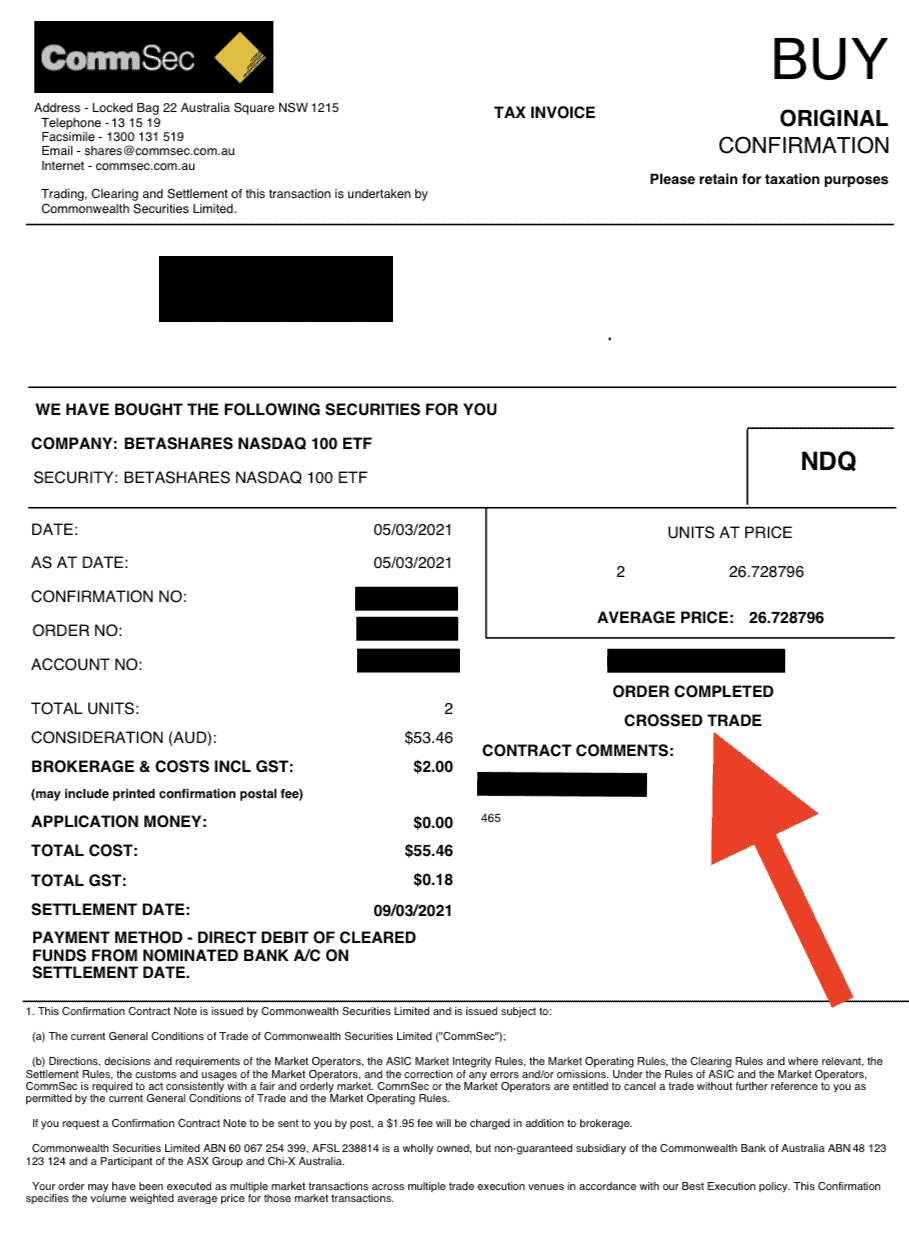

After you place your first trade you will receive confirmation of your trade with a contract note sent to your email address, it will look something like this:

You’ll notice on this contract note, as highlighted by the red arrow, that the trade performed by CommSec for my NDQ stocks was a “Cross Trade” – this is where a broker marries both the buyer and seller together at the market price. I think then this is how CommSec makes it money from the ETF trades, especially being Australia’s largest stockbroker, they simply match buyers and sellers within their own order book.

Conclusion

If CommSec Pocket continues to increase in popularity they may continue to broaden the availability of ETF’s, especially considering there are other competitors in the market offering free brokerage on ETF transactions (you just don’t own the stocks).

Overall, I was impressed at the simplicity of CommSec Pocket and the ease of being able to transact on the platform. Next we’ll explore the regular investment side of CommSec Pocket.