If you’re looking for an insurance aggregator that can scan a variety of home and contents insurers and present you with the best quote then start with Compare the Market’s home and contents insurance comparison website .

Our Recent Experience

Recently I looked around for quotes from insurance companies to see if I should renew with my current insurer or whether I should look elsewhere.

As we pay annually I had a limited time to try and find a new insurer otherwise we would just renew – the easy way out!

Unfortunately, progressing through each of the insurance quotes screens proved to be tedious. Some insurers would ask for details that others didn’t, but most asked the same sorts of questions.

It’s because of this that insurance aggregators, such as Compare the Market help customers out by performing all this leg-work for you.

Best Thing About Compare the Market

The best aspect about insurance aggregators is that they accomplish two great things:

- They save you time – saving you from going and hunting for the best insurance quotes; and

- They save you money – a quick comparison once you get to the results page is that you can see which quotes are the cheapest.

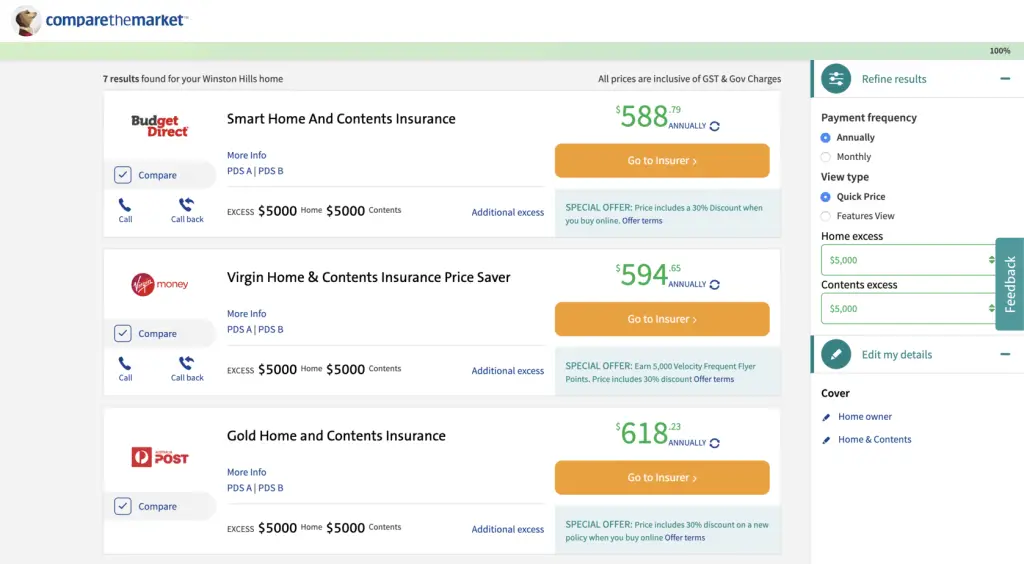

Here’s what I was able to see displayed in front of me once I progressed through all the questions:

Compare The Market’s Results

From the results shown above the cheapest result was $588.79 from Budget Direct. Considering the renewal of my house insurance with my current insurer was going to be $760.36 by using Compare the Market the scour all insurers for me I was able to save $171.57 for the year.

And you know what my beloved grandmother used to always say:

A penny saved is a penny earned. (My grandmother – all the time)

Another aspect I enjoyed about the results displayed from the website was how easy it was to edit any data point and see the impact it has on the premiums paid. For example, I played around with the excess quite a bit to see the difference it makes on your premium. If you’ve got emergency cash reserves that can easily pay for the excess selected then I’d highly recommend you use that figure to help lower your annual insurance cost.

When you do edit the excess settings be mindful that many insurers do not offer that level of excess. You can easily see the excess offered for both the house and contents insurance at the bottom of each insurer’s prices in the results section (in the screenshot above you can see I changed the level of excess to $5,000 for each which would mean if I had to make a claim for both the house and contents, say if my house burned to the ground and we lost everything, I would need to be able to fork out $10,000 to make the claim).

Compare The Market Feedback

While the results above were amazing the only frightening thing about the results was that I had never purchased insurance before from Budget Direct. This immediately raised doubt in my mind:

- Who are these guys?

- Are they legit?

- Are they a local outfit?

- Are they recommended by anyone?

Due to the doubt I had to pop the cork back onto the champagne and do a little digging on just who these Budget Direct people were.

Thankfully I didn’t have to hunt too hard. Upon entering a quick Google search I saw their glowing reviews:

Oh, it’s these guys.

I recollected when flicking through a Money Magazine several months ago at the local library they had received some Money Award.

But, just to make sure things were legit I decided to go to Budget Direct’s website and perform the quotes myself. When the quotes through Budget Direct matched what was offered through Compare the Market I proceeded with the quote directly from Budget Direct.

And this is Compare the Market’s biggest issue.

While I love their service, they need some little sweetener (like offering tickets at participating cinemas if you become a member similar to Telstra Plus ) to ensure customers purchase the insurance products through them, rather than the customer going off and purchasing insurance from the insurer’s own website (as I did).

More Than Just Insurance

While my discovery of Compare the Market was purely for our home and contents insurance, as my experience was a positive one, I did return and see they offer more than just insurance, but are a comparison website for other things such as your energy & gas bills, hotels, credit cards, home loans and even fuel!

If you’re looking for a means to determine whether you’re getting a good deal for your insurance, whether it be car insurance, health insurance, or home and contents insurance, then I’d highly recommend giving Compare the Market a go. Their aggregation tool helps scan your needs with a large variety of insurance companies without the need for you to go to each insurer’s website and complete each insurer’s quote forms individually – it saves you a tonne of time.

While there are other insurance aggregation websites around, such as iSelect, I have found Compare the Market pleasant to deal with and would certainly recommend them to anyone else looking to give them a try. I certainly will be using them again and I’m curious on how I can save in other areas now too.