After recently renewing our annual home and contents insurance policy this week I asked myself the question: Do I even need home insurance?

Check your mortgage, rental agreement and other loan documents as it could be a requirement within these contracts to have home insurance. Besides being a great way to mitigate financial disaster, if you do happen to live in an area prone to flooding, or fire, home insurance would help provide piece of mind should some natural disaster occur.

It should also go without saying that if you know of any possible issues that could cause damage to your home that having home insurance will not automatically cover the cost of rebuilding your home. If there’s known damage to the property it should be declared to the insurer so that they are fully aware of the risks they undertake by insuring your property.

Home insurance companies may even elect to exclude certain types of damage to your home based on the pre-existing or occurring nature of damage to your home.

I also found when I have refinanced our mortgage that it was a requirement of the new lender to furnish a certificate of currency showing you adequate coverage of your home before they would be willing to refinance your home.

So check your lending documents and see if there is a clause in the contract where, as the owner of the property, you need to maintain adequate coverage of your home.

And this makes sense from the lender’s perspective. They want to avoid having to foreclose and sell your property to recover the unpaid debt if all they have is the land to sell to recover their debt.

In the event something bad happens to your home, such as flooding, fire or some other disaster then based on the type of cover provided by your insurer you would be able to rebuild your home to the amount you had it insured.

How much does it cost to rebuild my home?

As I still am paying a mortgage on my property and one of the conditions in my mortgage contract is that I maintain home insurance the next question I asked and needed an answer for was: how much does it cost to rebuild my home?

Each year this value could change depending upon inflation, but thankfully there was a very handy online calculator that took the current dimensions of my house and helped to determine the approximate cost to rebuild my home.

CoreLogic provides an estimator to help determine the value of your home to rebuild.

Going through the form you are asked information about your home, and I found for my home most of the values were already correctly prepopulated (some were not):

- Construction Style (if you don’t know, use the year range as a guide)

- Original Year Built (this was already pre-populated for me)

- How far bushland is from your home (available options are >100m, between 16-99m, <15m)

- Slope of land (<10 degrees, 10-20 degrees, >20 degrees)

- How many storeys (split levels count as a “storey”)

- Standard of construction ( I’ll talk about this one a little more below , but the consensus provided by CoreLogic is that most homes would be Standard as they haven’t been architecturally designed or are complex)

- What type is the external wall of your house (i.e. brick veneer, double brick, etc)

- What type is the roof material (i.e. concrete tiles, terracotta, etc.)

- Floor area (thankfully I have a plan of my home with the total square area calculated)

- Number of bedrooms and studies

- Number of bathrooms and ensuites

- Number of separate toilets (not those in a bathroom or ensuite)

- Number of garage spaces fully enclosed with roof shelter

- Number of carport spaces with roof shelter, but open sides

- Number of balconies and decks with no roof

- Number of porches and verandahs with the majority having a roof

- Length of retaining wall on the boundary and inside the boundary (~10m, ~20m, ~40m)

- Number of cabins, poolhouses, sleepouts or granny flats

- If you have any heating or cooling devices

- The type of heating or cooling devices used (i.e. electric reverse cycle, gas heating, evaporative, etc)

- Number of standalone units

- Number of wood fireplaces

- Whether you have solar power

- If it is used for hot water, and/or for electricity

- Number of sheds and their type (small or large)

- Number of in-ground or above ground pools or spas

- Type of spa, pool (concrete, fibreglass, vinyl) and it’s size

- Number of tennis courts

- Surface material of the tennis court and if it has its own lighting

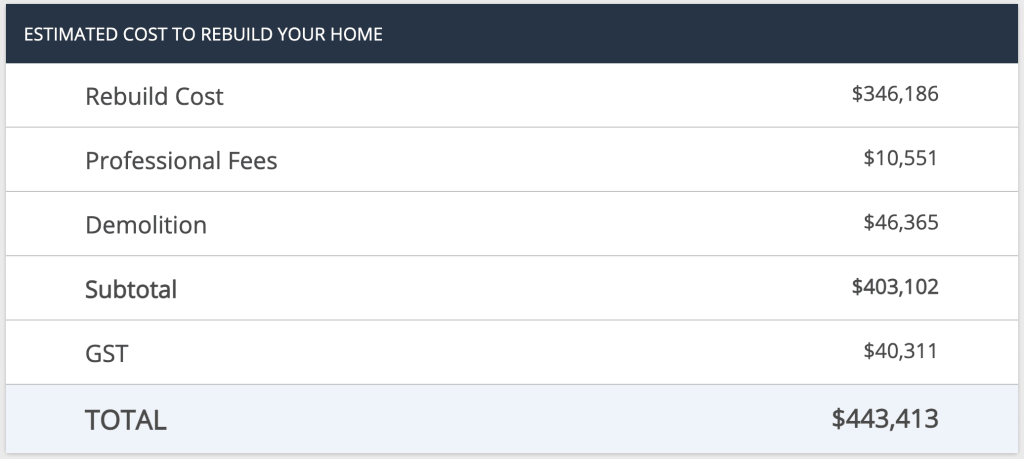

Once you’ve gone through all that data CoreLogic then provide you with an estimated cost to rebuild all these aspects of your home.

The above quote was what I received for what it would cost to rebuild our home with all the necessary fittings and particulars we have. Notice though that this is the standard build . This means that the cost to rebuild would be limited to a standard build cost with minimal variations to the house.

For example, a standard design would be matching the quantity of bedrooms and bathrooms you currently have, but would only be providing a laminated kitchen bench top & cupboard doors, basic appliances & tapware, basic aluminium windows, simple architraves & skirtings, plain ceilings & cornices, average ceramic tiling, minimal electrical facilities (etc).

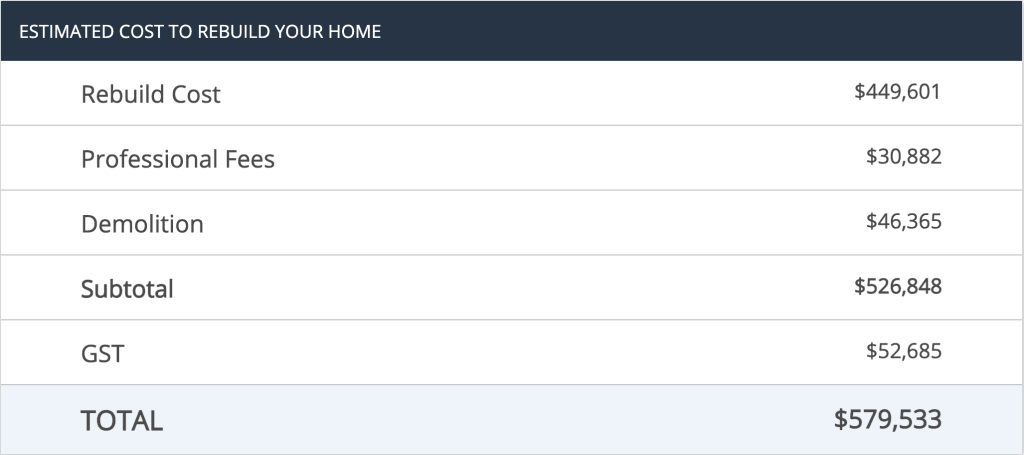

In contrast, if there needs to be some variation on the build, for example, granite kitchen tops, featured doors, larger architraves & skirtings, timber or improved aluminium windows, semi-framed or frameless showers, decorative ceilings & cornices, European appliances & tapware, an architectural design (etc) then the cost will be a little higher than standard.

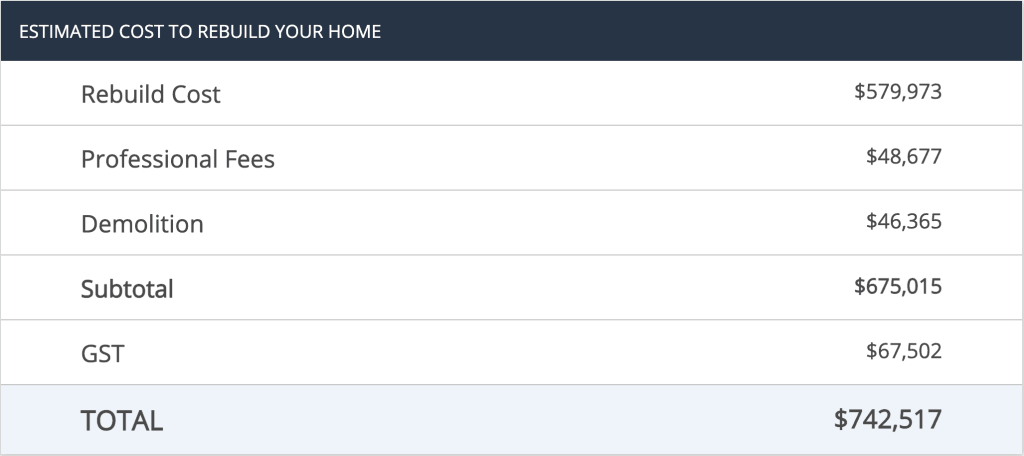

Finally, if the required rebuild of the house will be quite complex and to rebuild the house will require the top facilities, extensive electrical work, stone tiling, solid timber cupboard doors, European door furniture, European appliances & tapware (etc) then you should select the Prestige option of the construction type required.

As you can see the difference between the Standard and Prestige build is a difference of 67% !

What impact does it have on insurance?

It should go without saying that when it comes to home insurance you want to make sure you are adequately covered. The calculator provided by Core Logic is a tool to help determine what the rebuild cost of your home would be. Obviously, you would need to undertake this exercise each year as construction costs increase.

Now that you know the cost of rebuilding your home, this information helps to determine how much to value your home when purchasing home insurance.

When I recently undertook renewal of my home and contents insurance one of the fields I was required to complete was the valuation of my home. The form did not auto-populate a number, and I had to enter a figure.

For our home valuation I chose the mid-point between the Standard build cost and the Quality build cost – I entered a round number of $520,000 as I assumed that there may be some variations required to build our house, but having thought about it a little more I’d probably just go with Standard construction value next time.

The cost of renewal for my home and contents insurance ended up being a premium charge of $712.

Effect of Home Value on Home Insurance Premiums

By looking at the different values of my home using the home insurance calculator provided by my insurer here’s how the premium cost would have varied according to the home values presented above:

| Construction Build Type | Annual Premium Cost |

|---|---|

| Standard | $686 |

| Quality | $766 |

| Prestige | $906 |

As you can see from the table above, there is a difference in annual premium of $220 from the Standard construction build cost compared to the Prestige .

If you want to save even more money than what I did when renewing my home insurance you could choose just the Standard rebuild cost as the valuation amount for your home, but remember what you would be getting by choosing this option.

Summary

It’s important to have home insurance to protect you from financial difficulty should you need to repair your home yourself. While some insurance companies may exclude some types of damage, it’s important to shop around and find the right type of coverage.

It could also be tempting to insure your home for more than what it is currently worth, but the main point of home insurance is not to upgrade your home should you lose it, rather to replace your home with a like-for-like type building.

Hopefully, this article has helped to prevent you from over-insuring your property, as paying too much home insurance impacts your budget. If you’re looking for further ways to minimise your home and contents insurance bill you might want to check our other article on how I was able to save over $1,700 on our recent insurance bill .