The financial year cycle for Australians starts from the 1st July in the previous year and ends on 30th June in the current year. When reporting to the government your financial activities you will be using transactions that were incurred during that period of time.

Nobody likes to pay tax yet for some we don’t know what we should be claiming for to help us legally minimise our tax.

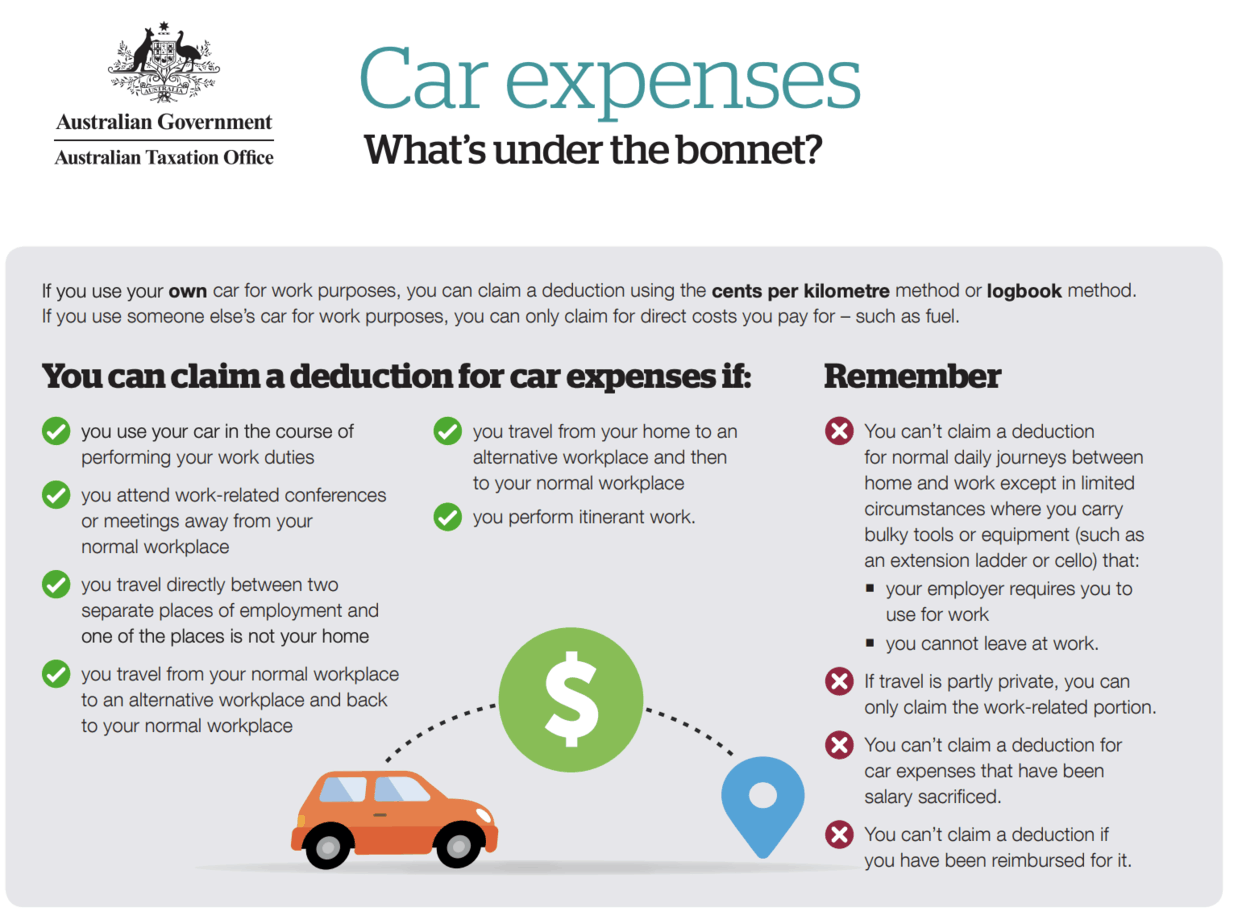

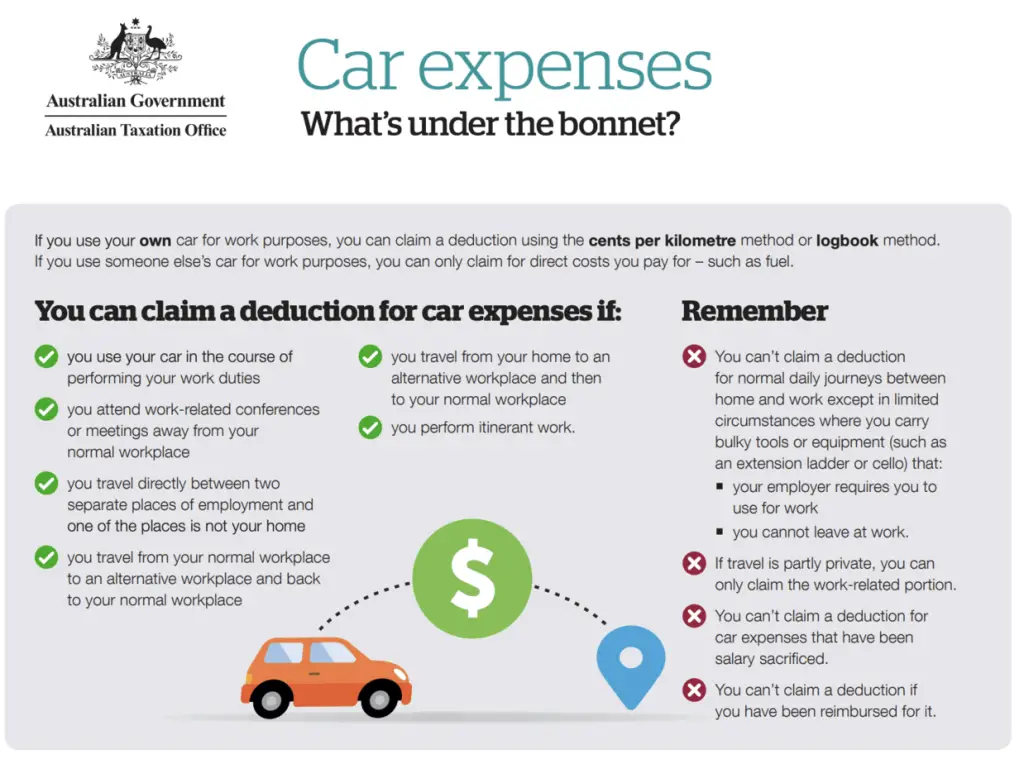

One popular method to help minimise your tax is to declare your work related travel expenses.

What is a work related travel expense?

A work related travel expense is travel you undertake solely for work purposes. For example, you may be required to travel interstate for business, or even just locally to deliver important documents.

For example, when I was at work I was instructed by my boss to deliver some important mortgage documents to our bank due to a property purchase happening within a couple of days. I was using my own car to perform the delivery, so for that return trip I clocked the distance, the date when it happened and the nature of the travel.

Travel though to work from home is not considered a work travel expense . However, if you have two or more jobs and commute from one work place to the another then this is deemed to be an allowable deduction .

How to calculate my work related travel tax deduction?

There are two ways you can calculate car expense deductions , one is by writing details in a log book , the other method is by maintaining a register of travel on how you calculated your total distance travelled – this can only be up to a maximum of 5,000 km per car and is known as the cents per kilometre method .

Personally I prefer the cents per kilometre method as this is an easier form to manage. All I do is write down the date of travel, the number of kilometres travelled and the purpose of that travel. I tend not to travel 5,000 km per year so this method I find very convenient for my needs.

For more details on car expenses, please read the helpful ATO car expense website , and have a read of the summarised car expenses PDF.

One another aspect to consider in regards to car travel expenses is whether you can get a reimbursement of your travel from your employer directly. Some employers may offer full reimbursement if you have a receipt, or they may offer a cents per kilometre reimbursement if you can have your claim authorised by someone (generally your manager).

If you do happen to get a reimbursement from your employer for the work related travel be aware that you’re then unable to declare this as an allowable deduction as you’ve already received a reimbursement for it.

Summary

Whether you’re receiving a tax deduction on your income tax return or receiving a direct reimbursement for your work related travel expenses it’s important to keep in mind when you are travelling for work. Note down these travels on your phone in some common area where you will not forget so that it’s easy to remember come tax time.

Don’t make the mistake of annotating your travels and then forgetting all about it at the end of the financial year.