Recently I renewed our comprehensive car insurance, and I began playing with the toggle on choosing market value or agreed value of the vehicle. Depending upon the type of choice and setting of each the premium varied by a few hundred dollars.

So is one better than the other?

If you choose market value as the amount of the policy this would mean your insurer would pay you the amount of your insurance policy should your car be completely written off.

How do insurers obtain a “market value”?

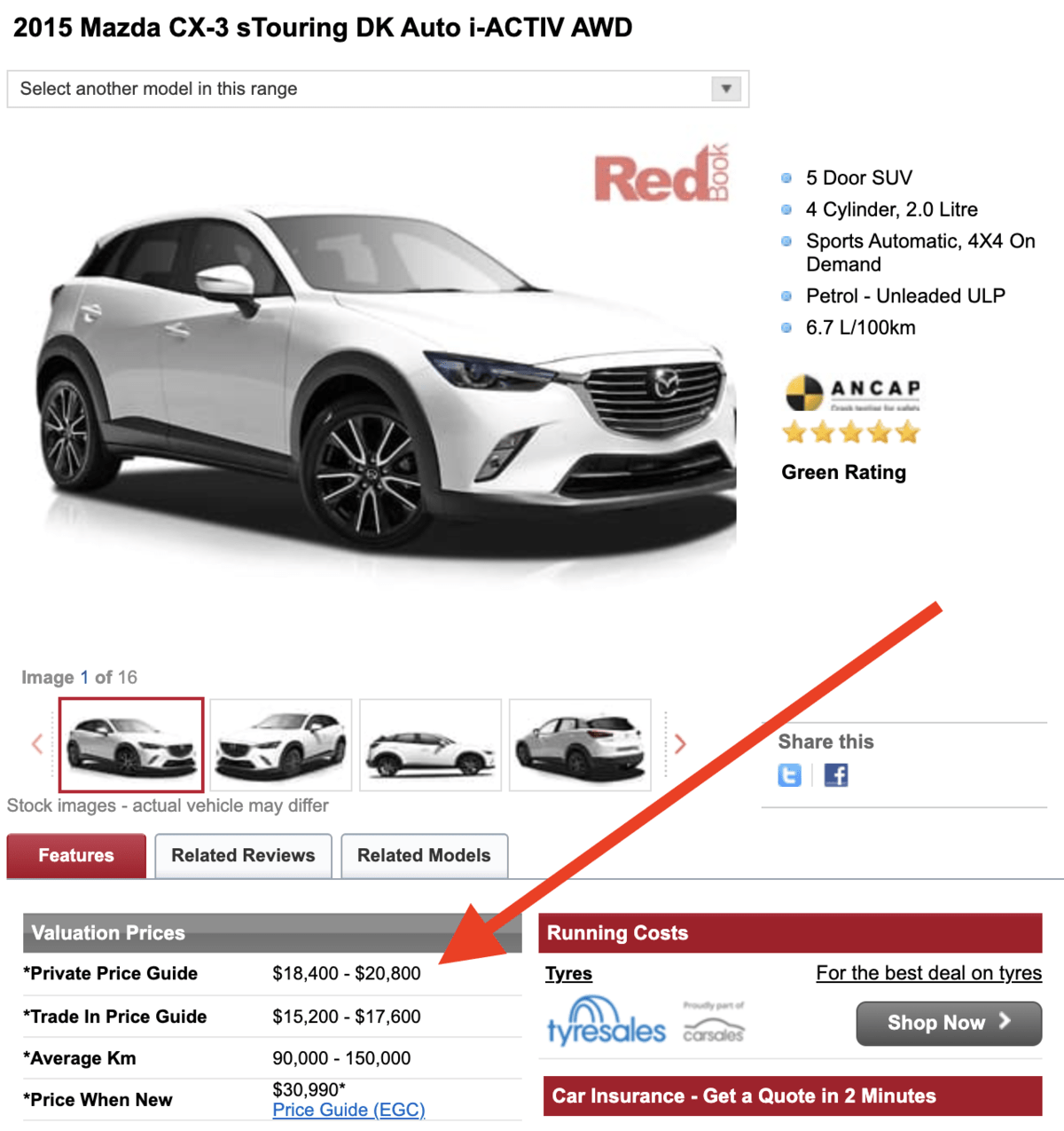

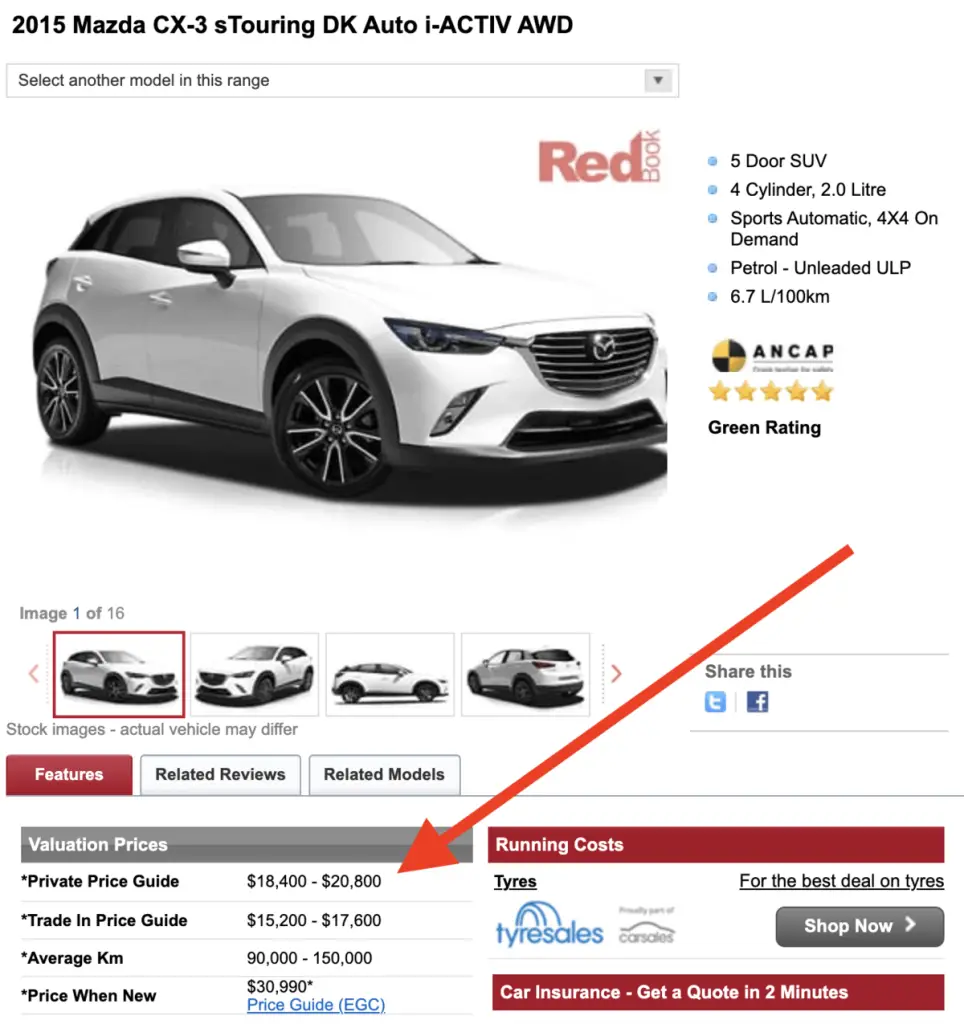

A popular website here in Australia for getting the current market value of your vehicle is to go to Redbook . Once you’ve entered your vehicle’s details you will get a price range of what your car is worth.

For example, here is my 2015 Mazda CX-3 vehicle’s valuation:

This price range gives an approximate value of your vehicle and the likely replacement cost for the insurer to cover payment for the same vehicle.

In most cases, the insurer would just pay out the market value of the vehicle, likely the mid-price of the range.

This does present a minor problem for users as a car generally declines in value the older it gets. Therefore, the value of the policy reduces over time.

What Is Agreed Value?

Slightly different from the market valuation, an agreed value is where you set the value the insurer needs to pay should the vehicle be written off.

To consider an appropriate valuation you will want to consider the following:

If your car is written off how much would you need to get back a like vehicle?

This considers not only the amount you need , but also what money you currently have in savings.

Should you need a new vehicle and your car is written off, how much in savings could you use towards the purchase of your new vehicle, and how much would the value of that car be?

However, be mindful that you also may be personally injured and there may be out of pocket expenses that you might also need to fork out. But if you health insurance this might not be much of a concern.

This is why it can be a little tricky determining exactly what to do when choosing an agreed value.

If you want to reduce your premiums then electing agreed value and choosing the lowest range will help save you money. Or, if you want to choose a higher value for your vehicle because you want to factor in the excess your insurer will reduce the payout by then you may choose a higher agreed value.

What Is Excess?

Excess is the amount the insurer reduces your claim by. The higher your excess the less likely you are to make a claim, and the lower your insurance premiums.

For example, if your excess is $2,000 and the repairs needed on your car after an accident and you submit a claim totalling $2,500 your insurer will pay you $2,500 less $2,000 = $500.

Therefore when factoring what to place as an agreed value for your vehicle you might want to consider the excess with your insurance policy so that your payout will be the actual amount of what you need to purchase a new vehicle.

For example, if you need $10,000 to get a new set of wheels and the excess of your policy is $2,000 then you might want to consider setting the agreed value to $12,000. This would mean on a payout by your insurer would be $12,000 less $2,000 = $10,000.

Summary

I personally prefer setting my car insurance value based on an agreed value. It gives me peace of mind knowing that I’ve insured my vehicle for a specific value.

If you’re looking for further ways to reduce the overall cost of your car insurance premiums you can elect to a reduced agreed value of your vehicle.

Be mindful if you do reduce your agreed value, do be aware that the total amount paid by your insurer will be less the excess.

As you continue to build your savings, it can help to further reduce your insurance premiums by using your savings to help contribute towards the cost of a replacement vehicle.