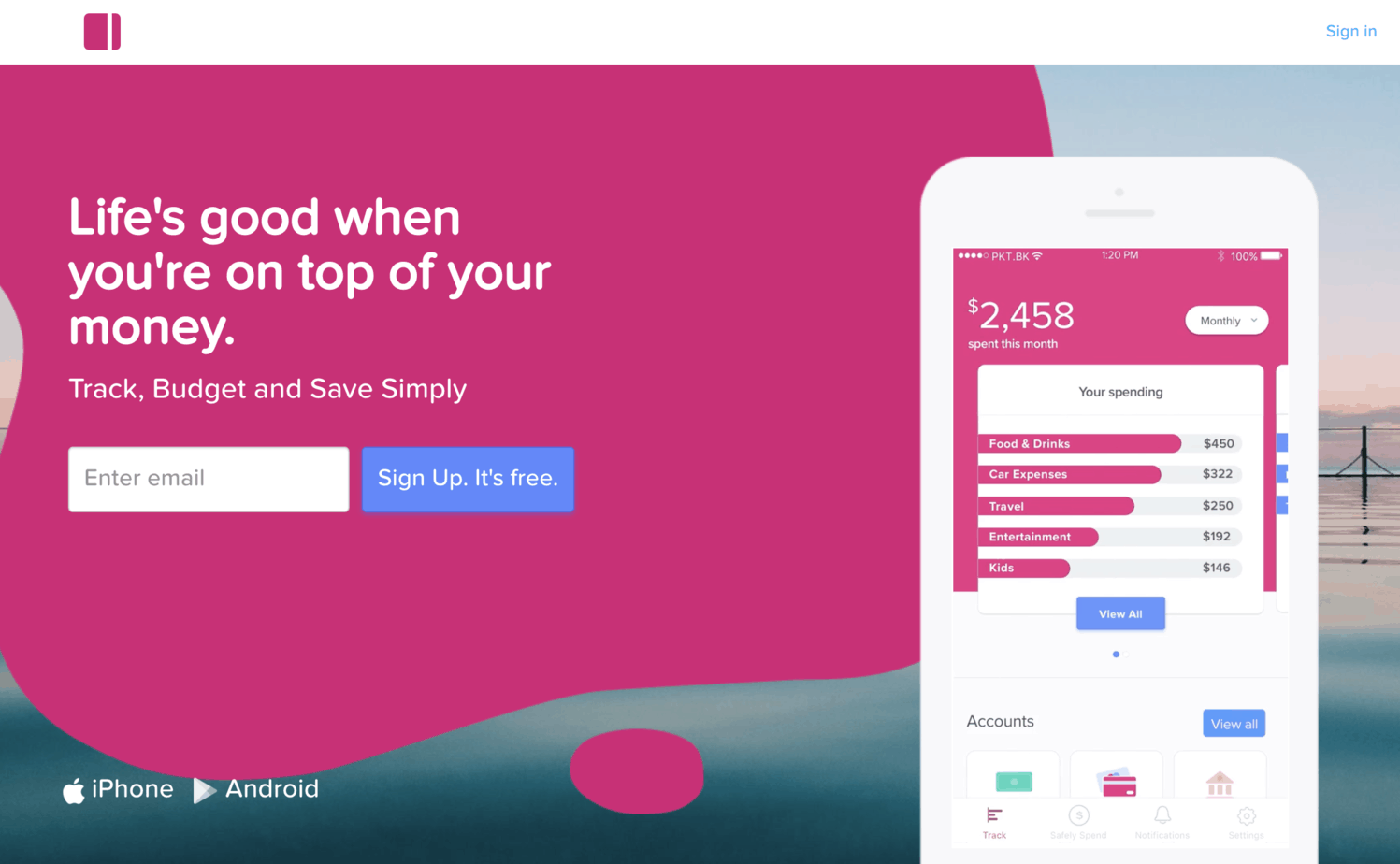

If you’re looking for a way to start organising your personal finances without spending any money on the process then Pocketbook is a great place to get started.

I’ve been a user of PocketBook since as early as 2010! While I’m not an active user today, I still appreciate how it has helped during those initial years.

PocketBook syncs very well with Australian bank providers, however, it probably won’t be something utilised by people outside the country.

What’s great about Pocketbook?

What initially will appeal to you, as it did to me, was the cost. PocketBook is a free service which automatically fetches your bank data.

I’ve been somewhat thankful for the service as I’ve used PocketBook long enough and it has been able to gather quite the financial history on my transactions. It’s also helped that I haven’t changed my transactional bank all too often too. The benefit of this feature is that it provides more historical data than even my bank provides!

Advantages

Besides offering an easy and free data fetching service there are some other aspects that I like about PocketBook are:

- They provide tagging and categorisation. I like how they apply hash tags to transactions – it’s an easy way to distinguish whether something is a category label, or a tag label.

- Nice graphs on what you’ve been spending your money on.

- Set up bills on a calendar.

- iPhone app to easily record transactions. They now even have a Watch app too!

- Automatic categorisation of transactions according to previous selections. Although this can be a little annoying, and I’d really like if a transaction could be locked to a category. While automatic categorisation is wonderful with helping to ease the pain of manually going through thousands of records and assigning categories to them, it can be a pain where you just have one transaction that needs a different category to the rest.

Pocketbook Feature Requests

There are a few things I’d like to see in the application, on my PocketBook wish list are:

Nested Categories

Currently, the only way I’ve done nested categorisation is by creating really long category names, like:

Bank - Fees - Credit Cards

Bank - Fees - Mortgage

Business Expenses - Web - Hosting

Business Expenses - Trading - Hosting (VPS)Even with this technique you can’t get totals of each heading, unless you export to a CSV file and perform analysis in Excel.

Forecast

I never really understood the importance of forecasting until my wife and I had to figure out whether we could send our son to school X, Y or Z – with each school massively differing in price. Obviously we wanted to send our child to the best school, which in this case just so happened to be the most expensive of the three.

Therefore, I had to perform some spreadsheet analysis on the impact of each decision for whether or not we could afford to do enrol our child in a school and unfortunately there’s no method in PocketBook that allows for such analysis.

With the ability to provide forecasting it would then be nice to offer projections.

How are my finances going if I look

x

years into the future?

I’m considering purchasing a new car soon, what impact would this have if I purchase at this time, or if I lease and have to make these payments? Which one leaves me better off?

Reports

Some apps provide reporting features, but there’s not a lot in PocketBook. At least not yet. A feature I haven’t seen anywhere within the personal finance apps is the ability to create custom reports – so this could be something that PocketBook could knock out of the park if implemented well.

I guess, in a sense, if you have nested categories you’ve almost got your own custom report right then and there – but if you wanted to see a collection of categories and what they total this would require some customisation besides the regular Cashflow and Budget/Actuals reports.

API.

Okay, now I’m being greedy.

An API would be nice. I like how Google Spreadsheets can easily connect to services and if I ever wanted to do further analysis it would be nice to have to play with.

Perhaps this would be a better option than providing Custom Reporting?

Conclusion

Pocketbook is a great little cloud service connecting all your bank feeds and providing easy categorisation. If you want to start organising your personal finances, and your bank doesn’t provide adequate categorisation of transactions then look at starting with Pocketbook .