Are you looking for a quick and easy way to manage your personal finances? I know I was many years ago, and it seemed every solution I turned to just wasn’t working well. So to help keep on top of our finances, I tried Quickbooks from Intuit, and since 2016 I’ve been using Quickbooks to help keep on top of our money.

While Quickbooks Online does not offer a personal edition, it is a very flexible online accounting package that allows you to connect to your bank accounts, automatically categorise transactions, upload receipts, and get your data in a myriad of different reports.

While having some bookkeeping skills will help, it’s not terribly difficult to get started, and you’re free to try the software for a limited time (usually 30 days) to see how you go.

Can’t You Just Use Your Banking App?

There are several reasons why my banking app no longer meets our needs for our personal finances, here were the reasons why I moved to Quickbooks Online, see if some of these may apply to you too:

Reason #1 – Small Business/Side Hustle/Hobby Need

When my wife and I started an associate lease arrangement with my employer, I needed a way to be able to properly categorise the running costs and lease income received to her for the vehicles in her name. This was important as these transactions were needed on her personal income tax return.

If you have a hobby, or a small business, then you may want to keep an eye on whether it actually makes money. By separating out the transaction corresponding to the side hustle, you will better be able to see if it’s doing well or not.

Reason #2 – Non-Cash & Non-Banking Transactions

Not all transactions are cash-based, or are done in your bank accounts, and yet you still need to monitor them. Some of these types of transactions include:

- Depreciation of motor vehicles (which can be declared with an associate lease arrangement).

- Cash gifts received (for birthdays or anniversaries).

- Cash withdrawals from the ATM that are used for multiple purposes (gifts, food, etc).

- Superannuation account amounts/values.

- Property appreciation.

Reason #3 – Splitting Transactions

Another shortcoming I came across was the flexibility of being able to split a transaction. While this isn’t a big problem if you have broad categories, it does become a pain when you budget for certain items, but then have them bundled together.

For example, I separate out internet and phone costs, as there was once a time when these items were done through different providers. Now, though, these items are bundled together with the one provider, but I still need to split these out to their respective accounts in Quickbooks. I found I couldn’t split transactions with my banking app.

Reason #4 – Categorising One-Off Transactions

Another shortcoming was the ability to automatically categorise transactions, future and historical. I found some apps when I applied a category change to one transaction, it went and changed ALL the historical transactions that were similarly categorised! Ugh!

Sometimes I just want to apply a category to 1 specific transaction from a supplier, and not to any historical or future transactions from the same supplier, but some banks will not allow for this to easily occur.

For example, sometimes we purchase items from our local store (BigW) for clothing, or home wares (appliances or furniture), or something as a gift to somebody else. Having the flexibility to change the categorisation of the transaction is easily handled with Quickbooks depending upon the nature of the expense.

Reason #5 – Automatically Categorising Transactions

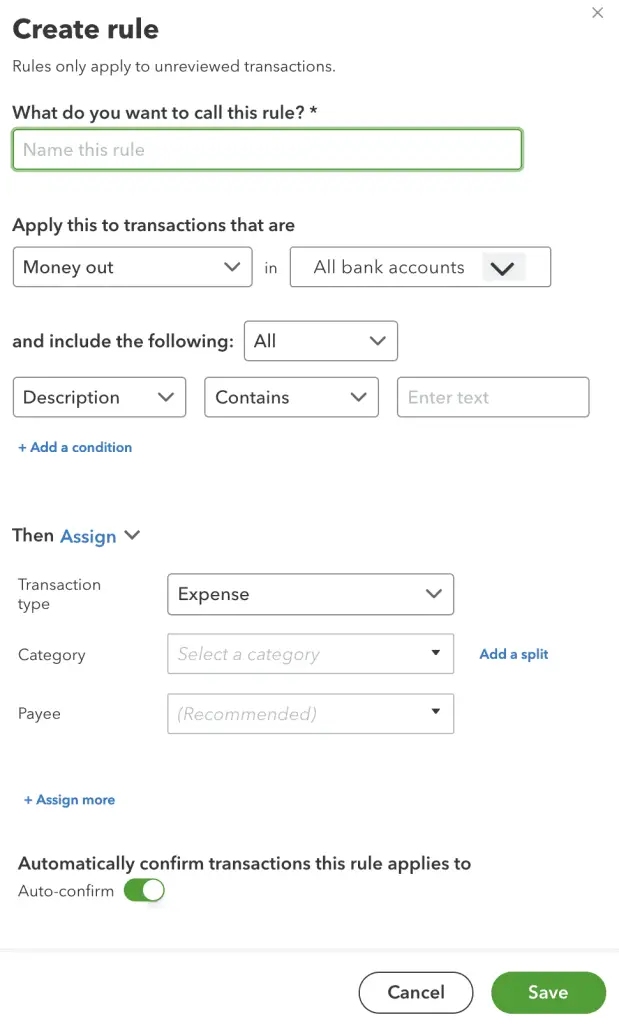

There are some transactions when they are processed from a specific entity, or for a specific amount, or bank account that are handled the same way every time. If you find you have this happening a lot you can set up a rule to automatically apply categorisation on transactions that meet certain criteria.

In Quickbooks you have a lot of flexibility and power in being able to identify a transaction to categorise. Some options currently available to help find the transaction to automate its classification are:

- Is money coming in or going out?

- Where will this transaction be found? You have the option of selecting one bank account, or many.

- How to identify it? Base it on one condition, or multiple conditions.

The available options with each condition created are based on:

- Description

- Bank text

- Amount

And the type of condition checks available are whether the input contains a certain type of text, doesn’t contain the text input, or exactly matches the input.

Once you’ve then established the type of transaction to apply an automation to, the next step is to then set what you’d like to do with it. The available options are to just exclude it from classification altogether, or to assign it to a specific category, or multiple categories.

If you need to split a transaction into multiple categories, you can split it based on a percentage, or by a fixed amount. The last category automatically captures the remaining amount.

Finally, there’s the ability to turn on these rules set above to automatically apply everything you’ve set. You might want to leave this off initially, and once you’re satisfied it works after a specific amount of time, you can then come back to this rule and apply the automatic handling.

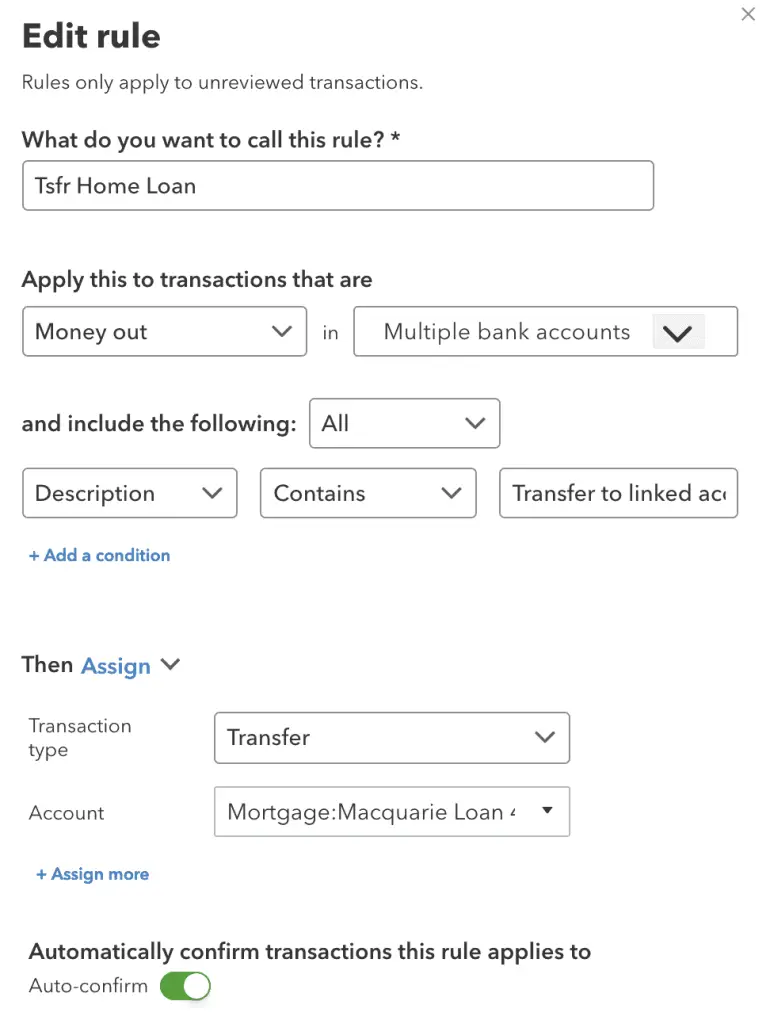

For example, I currently have a condition where for money going out from multiple bank accounts to our mortgage account. These transactions are specifically identified by text in their description. Every time that transaction pops up in my transaction list, it’s already applied the rule and shows a tag “rule” to help me identify the transaction meets a condition I’ve created.

I then swipe it in the online Quickbooks app, and the transaction is handled as I wanted.

Reason #6 – Tax Time Reporting

When it comes to the end of the financial year and I need to find out what my allowable deductions will be for the tax year, I can easily run up a report in Quickbooks to obtain this information.

I can similarly find transactions I’ve tagged as “tax” in my online banking app, but this can be problematic if a transaction needed to be split between personal use and work use. Unless I’ve written a comprehensive note about this on the transaction AND have read the note when it comes to tax time, then I may not apply the deduction properly.

Being able to split accounts and place transactions where they need to go throughout the financial year, I don’t have to spend time trying to go through transactions trying to find where that taxable deduction was, now I just bring up a report that helps to identify these transactions!

Also, it makes it relatively easier for your accountant to be able to login to your Quickbooks account and fetch what they need to help provide a better income tax return for you if you outsource your tax returns to an accountant.

Reason #7 – Managing Multiple Bank Accounts

If you have multiple bank accounts, then it can become problematic managing the classification of your transactions if these accounts are not in the same banking login.

Therefore, it can be problematic trying to do a budget comparison when information of your transactions needs to be sourced from multiple locations. If that is the case, it may be more beneficial for you to use Quickbooks online and to have all your transactions synced automatically in one centralised location.

By keeping everything centralised, it helps to manage and monitor your cash balance.

Where Quickbooks May Not Be A Good Fit For You

If your financial needs are simple and all your cash and banking is done in one or two bank accounts and this is adequate for your needs then you do not need to look at getting an online accounting software licence.

If you already use your bank or another online provider to categorise your transactions, and it’s working for you, then again, you do not need to have Quickbooks.

If you cannot afford the cost of the basic plan per month (I’m currently on the Simple Start Plan) without any discount, then don’t get Quickbooks. But before you do go and sign up, may I caution you with one important thing that I bumped into and found out the hard way:

Quickbooks Downgrading To Simple Start

If you do decide to get Quickbooks Online may I caution you to start on the most basic plan you can afford . It can be very tempting to get a plan with all the bells and whistles, but there’s a big problem you’ll encounter that I unfortunately had to deal with – downgrading to a lower plan.

As each plan enables certain modules within Quickbooks Online, there are extra bits of data and transactions that are performed because of these modules. Therefore, when you downgrade and remove these modules, there’s an issue that is faced with handling these transactions.

Unfortunately, there’s no easy solution that I’ve been made aware of yet where Quickbooks allows you to downgrade your plan, and you run the risk of data loss. I had to start all over again with my historical data, and I hope you don’t have to do the same. Therefore, my recommendation is to start on the lowest plan possible and upgrade only when it’s really necessary to do so.

Summary

Quickbooks has been my preferred solution to help manage our personal finances since 2016. With just one login, I can access all of my bank accounts in one centralised location, and I can easily categorise transactions based on conditions and rules I’ve set.