If you want to invest in ETFs on the Australian stock market what are your options, and what is the cheapest way to invest?

Currently there are 3 very easy ways to invest in ETFs listed on the ASX that are different from the standard way of investing through your traditional Australian online broker (i.e. CommSec, NAB Trade, Macquarie Online Trader, etc.)

And these three are:

- Raiz Invest (managed or custom);

- CommSec Pocket (limited basket of ETFs)

- Superhero

Let’s compare all 3 together by asking questions and seeing where they differ and find common ground.

How many ETFs are on offer?

|

|

|

| 7 ETFs | 14 ETFs + Bitcoin | All ASX ETFs |

How much does it cost to invest in an ETF?

|

|

|

| $2.00 or 0.2%/trade | From $3.50/month | $0.00 fee bro! |

Raiz Invest’s fee structure is a little more detailed compared to the other 2 as they have different portfolios. If you’re investing in a standard portfolio is costs either the greater of $3.50 or 0.275% of portfolio value per month; if investing in the Sapphire portfolio the fee structure is $3.50/month + 0.275% of portfolio value; and finally if creating your own custom portfolio $4.50/month + 0.275% of portfolio value.

Do you own the ETF?

|

|

|

| Yes | No | No |

CommSec is a true stock broker where you will receive a HIN, while Raiz Invest is more of a managed fund, and Superhero will be the one owning your stocks (you get no voting rights).

Can I automatically invest?

|

|

|

| Yes | Yes | No |

You can make regular withdrawals from your personal account into these investing apps, with Raiz going another step further and allowing you to round transactions and they can take the rounded difference and deposit it into your account too!

What is the minimum investment amount?

|

|

|

| $50.00 | $5.00 | $100.00 |

If you’re looking to put your toe in and start small Raiz Invest is your best start.

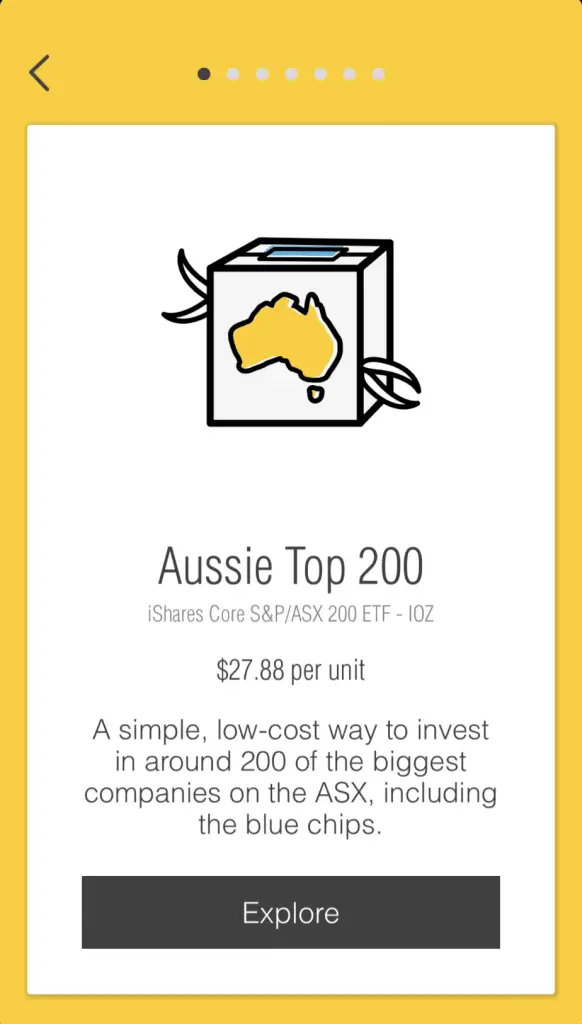

CommSec Pocket applies some sort of volatility measure to each trade, to ensure you’re likely to get the quantity of stock you want. For example, currently IOZ is trading at $27.88:

To be able to trade the minimum investment of $50 I’d need to purchase 2 units.

2 \times 27.88 = 55.76

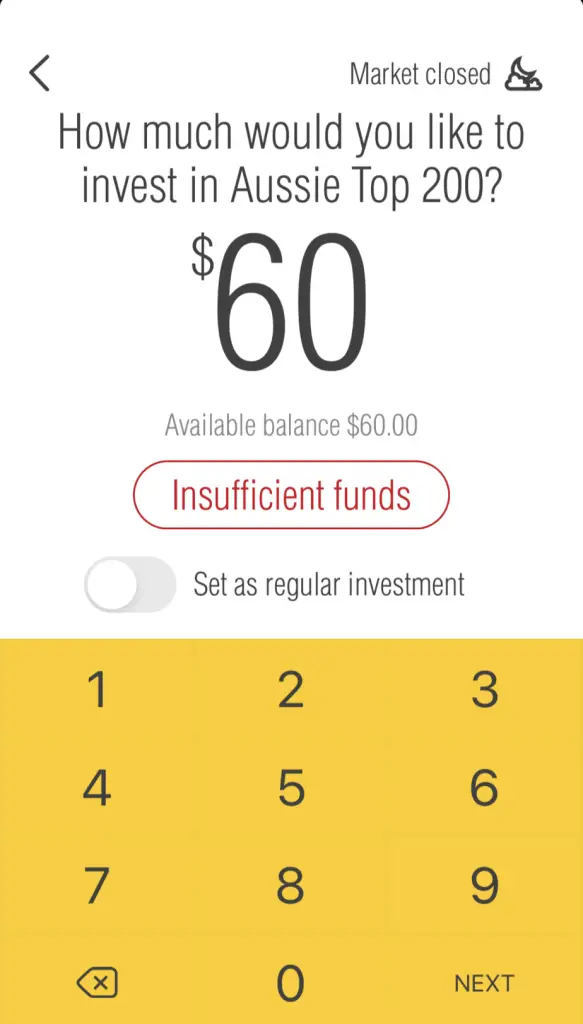

Therefore, I’d need an account minimum of $55.76 + $2.00 for brokerage which is $57.76. Yet when you go to purchase these units, CommSec Pocket advises you have insufficient funds if you happen to have $60 (3.8% more than required):

I can understand that during Market Close they may not want to accept any orders within a certain range from the last closing price of the ETF, but I’ve found the same is still true even when the market is open!

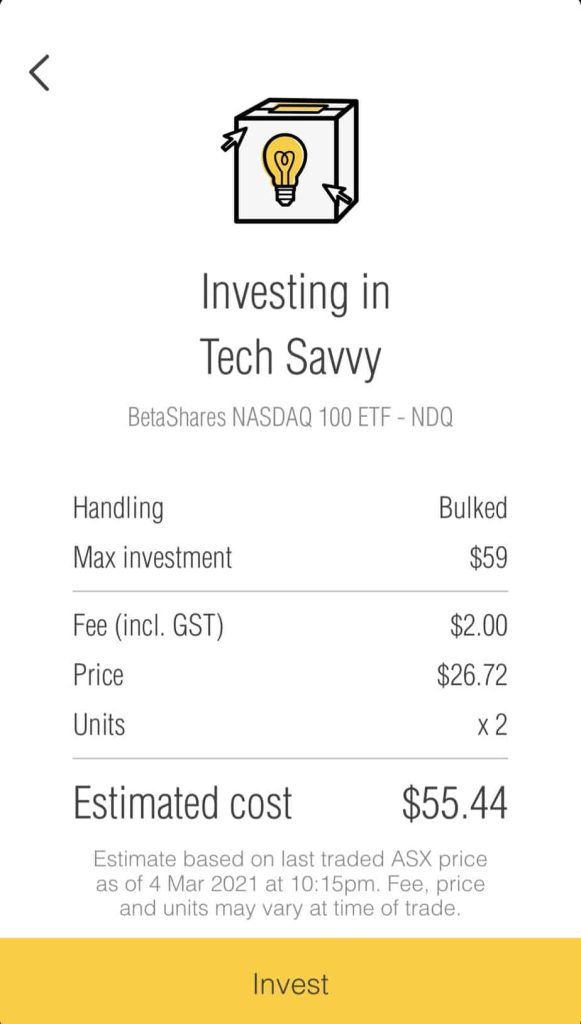

Eventually when the price is right you can get in. I was finally able to place a trade on the Tech Savvy NDQ ETF when the market sold off a bit:

Can I transfer existing ETF’s held by another broker?

|

|

|

| Yes | No | Yes |

Conclusion

Starting the investing journey into ETF’s is made easier with the help of innovative apps that allow you to get invested. Depending on your needs, frequency of investing, whether you want control of the ETF, or to have everything done automatically for you these apps will help cater you for your needs.