Budgeting can be a difficult task, but it is one that many people need to do.

A budget is simply an estimate of your income and expenses for the month or year. It helps you plan your spending habits so that you have money left over at the end of the month.

If you are disciplined about sticking to your budget, then it will help with financial stability in the long run and give you more freedom when making decisions on what to buy without having to worry about getting into debt.

In this article we will discuss 8 reasons why budgeting should be top priority for anyone who wants to improve their finances!

What is a budget, and why is it important to have one?

A budget is a plan for when and where income will be coming into your household and when and where money will be spent or going out.

It is important to have a budget because it helps you stay on track with your spending habits, feel more in control of your finances, and save for an emergency fund and for retirement.

Without a budget you will be prone to overspending which could possibly lead you to a situation where you might not have enough money it is really needed (such as emergencies). Without money this would leave you in a situation where you may have to acquire debt, which makes it very risky for the creditor to give you any money (as you probably don’t have the capacity to repay), or to sell some of the stuff you own, or to seek donations from family, friends or the government.

As many people who are on a budget know, it can be difficult to stick to it and can even be quite the shock when you get started, but the long-term benefits certainly outweigh the bad.

So to get you motivated in getting started we’ll go through a list of some of the benefits I’ve found since creating a budget and sticking to it throughout the last few years.

What are the benefits of budgeting?

- One of the biggest benefits I’ve discovered with budgeting is that it makes me more aware of where my money goes. It can be easy to think you have enough in your bank account when really it’s not until you need more that you notice how much less there actually is.

- It keeps you on track with your spending habits. It’s easy to buy something without thinking about it and then get surprised when the bill arrives. Budgeting forces you to think about each purchase to check if it is within the parameters of what you had planned within that month.

- It helps keep me in control of my finances and minimises stress. By maintaining control of my finances it makes me worry less about the future provided I’ve budgeted for a surplus. I know there will be months where I will be spending more than I made, but when viewing my budget over the year I can see that overall I will be net cash flow positive.

- It doesn’t cost anything extra except a little time. You’re just analysing what you already spend and checking whether your spending is aligning with your future. In fact, it has the potential for reducing costs, not adding more.

- It focuses more attention on the future rather than the present. It can be easy to make a purchase in the present especially with the way marketing grabs your attention and entices you with desire for the product or service on offer. Provided you have a strong reason for why you are budgeting, like paying off the mortgage quicker, saving for an emergency fund, having more in retirement, saving for a fun trip, then you can resist those strong marketing temptations.

- It makes you more disciplined. By resisting temptations and staying the course towards your financial goals it builds resilience. You will learn to say “no” a lot more than usual.

- It gives you a game plan and helps you save more once you’ve got savings. Once you’ve got some savings in place, such as an emergency account, you can look at converting monthly costs into annual costs and this usually is cheaper. The best example of this is usually car insurance, when you’re trying to save for an emergency fund you might initially start by paying your premiums monthly, as you might not have the cash available to pay for the larger annual premium, but once you do have enough saved you can now afford the annual premium and usually this comes with a discount than the annual sum of the monthly premiums.

- It leads to less friction and fighting within the home. It’s tough enough trying to remain sane with little ones running around, who constantly get injured or hurt or are sick, and the rest of the world falling apart around us. Doing a budget together sets the expectation and game plan for the month and sets in the mind of all involved how resources will be spent. It makes for less surprises and gets you on the same page.

Tips for sticking to a budget

Automate

Where possible set up automatic payment of your bills within your bank account. Some utility providers provide discounts if you allow them to direct debit from your bank account or credit card. Give them a call and ask them if they have this option and if discounts are provided by doing so.

Categorise

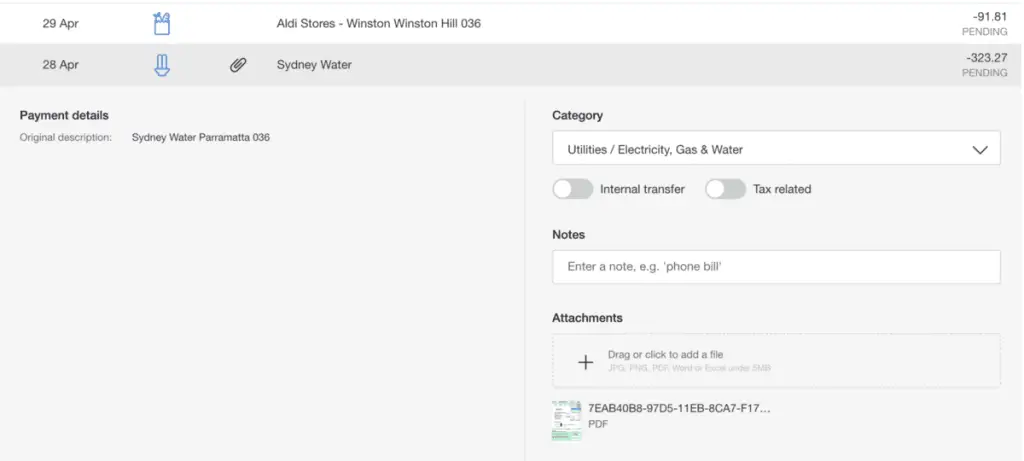

Use a bank that allows you to classify transactions easily. It helps if you have a bank that can work with you and that you have a system where you can easily check how you’re progressing against your budget targets. In Australia most of the big banks offer a form of being able to classify your transactions, but not many offer the ability to create budgets. I currently use Macquarie Bank and I like how they provide not only the ability to classify each transaction, but also a budget for each category for the month, the ability to tag a transaction for tax purposes, and the ability to PDFs of bills and invoices.

Calendarise

Make a time each month, fortnight, or week depending upon how often you want to keep an eye on your forecast. It helps if you can prioritise the start of the week, or the first of the month to go through your budget.

For recurring payments look at annotating them on your calendar and add a reminder a day or two before they are due to prompt you into going again another month with the subscription. If you haven’t been using it, cancel and renew again at another time.

Template

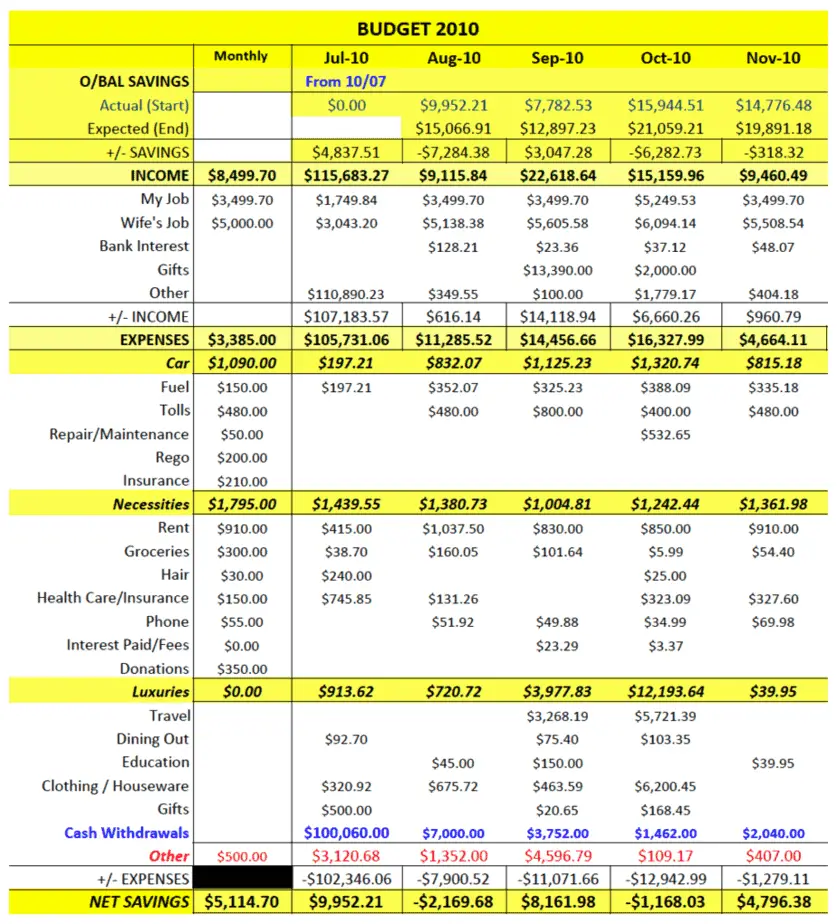

Create a budget template that works well with you. You might be thinking that it’s too difficult to create your own budget from scratch and you’re right – it can be hard! But by putting in a little effort now it can help you save time in the future when you’ve got a format you can use and work with.

Summary

Hopefully this article has helped to show you the importance of getting started with a budget. For many, budgeting can be an intimidating task – but it’s worth the effort!

Get started today by creating your own cash flow template, or borrow ours, pull it apart and make it your own.