When it comes to managing your finances, there are two concepts that you should know about: budgeting and forecasting.

Forecasting is the ability to predict how your money will be spent in a certain future period, whereas budgeting, is the process of managing your money according to what has been forecast in a budget.

What Will Your Finances Be In The Future?

Predicting what will happen in the future is a skill that is never truly mastered, but one that does get better the more frequent you do it.

When I first started doing a budget, I didn’t know what I needed to budget for and found myself just guessing my way through what I thought we spent our money on. It wasn’t until I compared my forecast to what I had budgeted that I realised I needed a lot of adjustment in my next forecast!

And this is the beauty of forecasting – when you start you’ll be terrible, and your first will likely be your worst, but as you continue to refine your predictions you’ll get better at it.

Some Forecasting Tips

Besides continually checking your forecast against what was actually spent other things to be aware of when you forecast are the following:

- Seasonal expenses

- Irregular expenses

- Multi-year expenses

How does knowing these things help with casting your budget?

Seasonal expenses

Seasonal expenses are those that vary throughout the year, they aren’t static or have minor differences throughout the year.

I have found expenses that vary with the season as follows:

- Electricity bills (I have found these to be smaller in the autumn and spring months, but larger in the winter and summer months)

- Gas bills (I have found these to be smaller in the summer and autumn months, but larger in the winter and early spring months)

- Holiday Travel (these tend to be larger during the Christmas-New Year period)

- Gift Expense (Christmas period)

- Transport – Fuel & Tolls (lower during the Christmas holiday period)

Read more about budgeting and forecasting seasonal expenses .

Irregular expenses

Irregular expenses are those types of expenses which fluctuate every week, or month. While these may not have a seasonal component, they do change over time and have different things that impact their value.

I have found examples of these types of expenses in my budget and to help with your forecasting ability you will want to translate these into how you forecast your expenses:

- Birthdays – not that some children will be given more than others, but I’ve found there are some years when one of our children would be celebrating a significant birthday milestone (at least for them!) that the costs would be higher than other years.

- Fuel & petrol – fluctuates according to fuel prices and is a difficult one to predict. If you are doing your budgets monthly, this can be adjusted according to the latest prices, but if you do budgets any longer than quarterly this could be a difficult one, and therefore you might want to keep a budget on the high side.

- Groceries – somewhat seasonal, somewhat unpredictable. This really depends on your needs and the number of children you have and their ages. Again, do budgets in shorter spurts, rather than over longer periods to maintain a close eye. With our family budget we always tip the budget to the hide side with this line item.

- Maintenance – cars, house, garden (etc). Cars can be unpredictable, but this gets better when you get a reliable car, and maintain it frequently.

- Medical – dental, doctor, physio (etc). It can be difficult to budget this, but I always get my dentist to give me an approximate amount before doing any work, and then schedule it into the next month if I can bear the pain!

As you can see the trick, if I can call it that, with the impact of irregular expenses on your budget is by doing your budget more frequently.

There are some irregular expenses that cannot be budgeted for, and will impact your finances, but this is why we have an emergency fund account – to minimise the financial risk these things can cause.

Read more about how to handle irregular expenses here .

Multi-Year Expenses

The last hidden type of expenses which can make forecasting difficult are those expenses which occur over multiple years. After doing a monthly budget for 12 months, I was confident on what was likely to happen according to what I had learned from the previous years’ month.

However, I soon realised there were some expenses that cropped up that were more than annual, and these are things you want to be able to add to your budget to be able to improve your forecasting skills:

- Driver’s licence – check when your driver’s licence is set to expire and add a cost for when it’s up for renewal

- Passport – again, check your expiry date on this document and add a cost for when it’s up for renewal.

- Birthdays & anniversaries – watch for significant birthday or anniversary milestones (round numbers like 10, 20, etc) as there could be an expectation to splurge on gifts or on celebrating on these types of festive occasions.

Forecasting Without Budgeting Is A Waste Of Time

My grandfather would often tell me that a ship wouldn’t leave the dock without having a map on where to go. If a ship has to plan where to go, why don’t you!

The beauty of forecasting is that it’s a plan to direct your financial future. Budgeting then is the ability for you to work out this plan by staying as best as possible within the constraints of your plan.

If you don’t follow through with what you had budget, then it just ends up being a fruitless exercise and a big waste of time.

Forecasting can easily be done with our spreadsheet app, but if this information isn’t placed into an app where you can regularly check your progress, it ends up being somewhat meaningless.

What Are The Best Budgeting Apps?

To track your progress against what was budgeted, there are several options available:

- Check if your bank permits you to create a budget.

- Check other apps that sync with your bank.

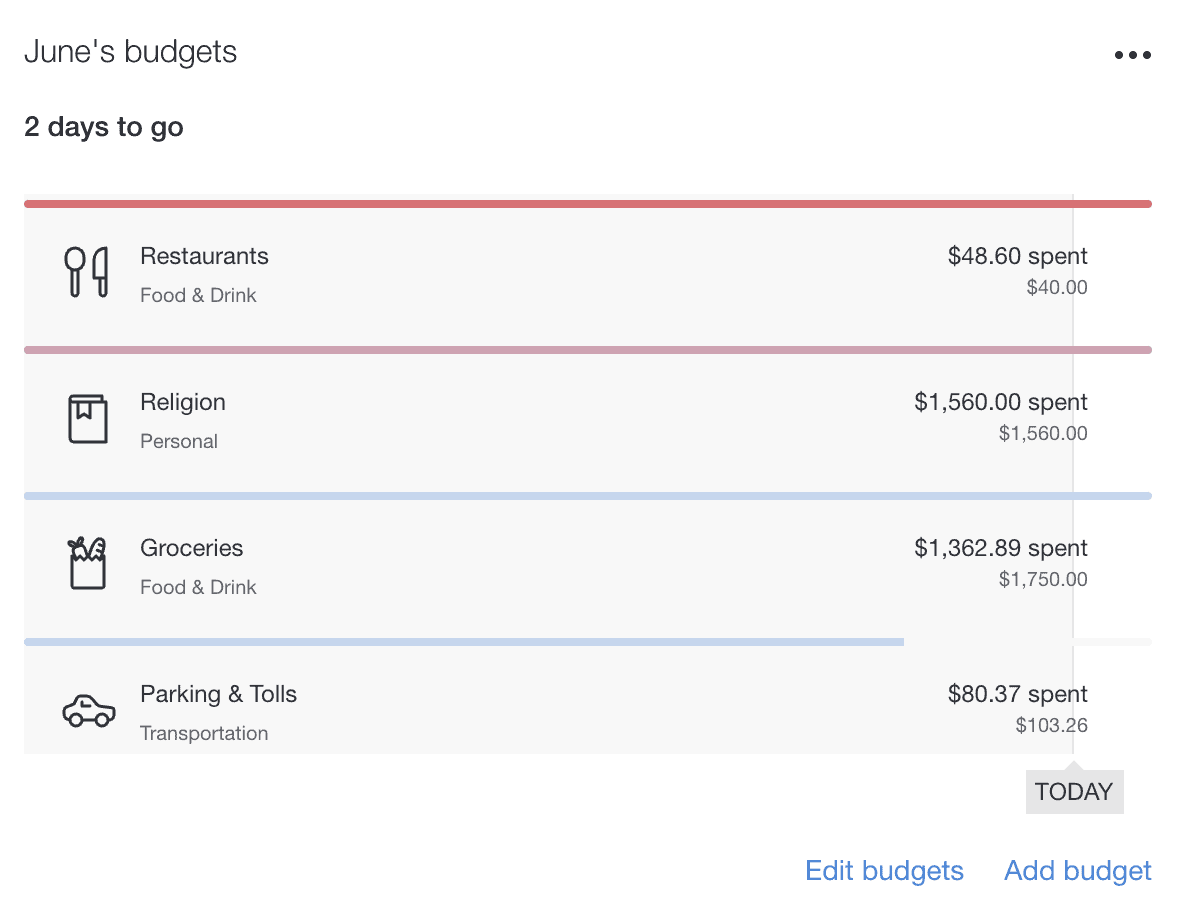

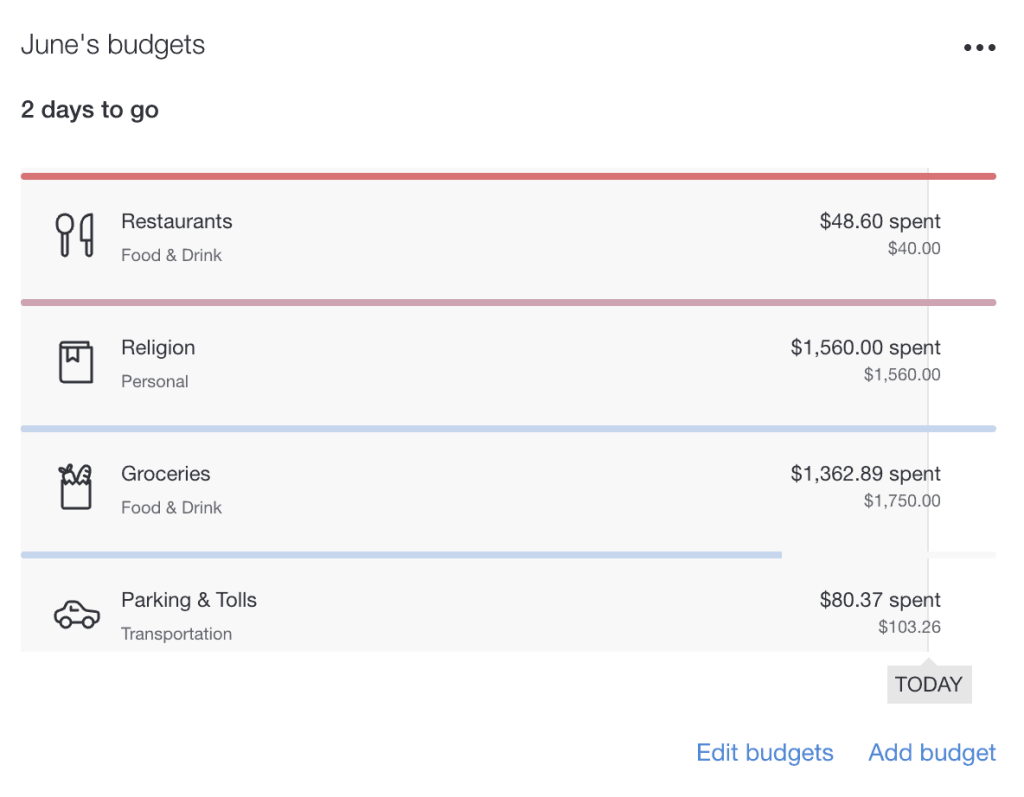

The bank I use has a simple budgeting feature that I use to check how things are going for the month, here’s a snapshot of how the current month is progressing for some of my budgeted items:

What About Quickbooks Budgets?

While I love and use Quickbooks to help manage my finances, I did try using their budget feature for around 12 months, but found the extra cost not warranting the benefits of the system reporting how well I was going.

The issue I then ran into was down-grading my plan to the cheaper option. This couldn’t be done.

Therefore, my recommendation for those who use Quickbooks to manage their personal finances to not upgrade their package solely on the budgeting feature . If you want to revert back, it’s a bit of a hassle.

Summary

Forecasting is predicting what will happen in the future, and you can best improve your forecasting abilities by looking back at your actual spending and asking: Is this pattern likely to continue in the future?

Budgeting is taking a budget and then implementing it according to what has been cast. It’s the strategy and action behind how you achieve your budgeted outcomes.