If you’d like to dip your toe into the stock market landscape and you’d like to invest in companies listed on the Australian Stock Exchange then one easy and affordable way is to invest through a new platform called Superhero.

Superhero is very attractive to those looking to micro invest in ETF’s or stocks listed on the ASX. Minimum trade size is $100, but to exit a trade can be of any size.

Brokerage starts a very attractive $0 for ETF’s and $5 per trade for everything else.

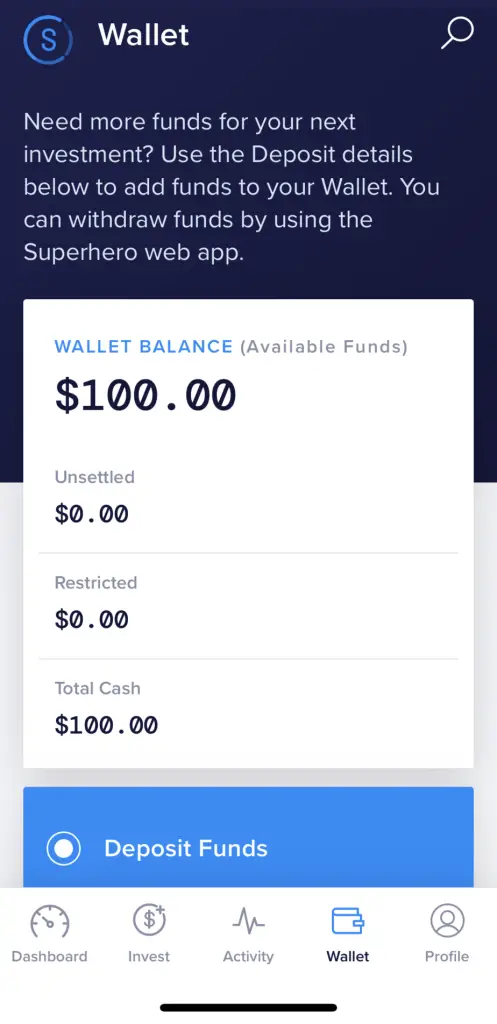

You can transfer your existing shares to Superhero, and transferring funds is very simple (and extremely fast!) using PayID. The only other available method of transferring cash to your account is by BPAY which Superhero charges $1.00 in fees (therefore, you’ll need to transfer a minimum of $101 from your side if using this type).

(I had never used PayID to transfer funds before, and was very impressed at how quick funds landed in my account! Superhero also sends you a text message confirming your deposit.)

Ready To Trade

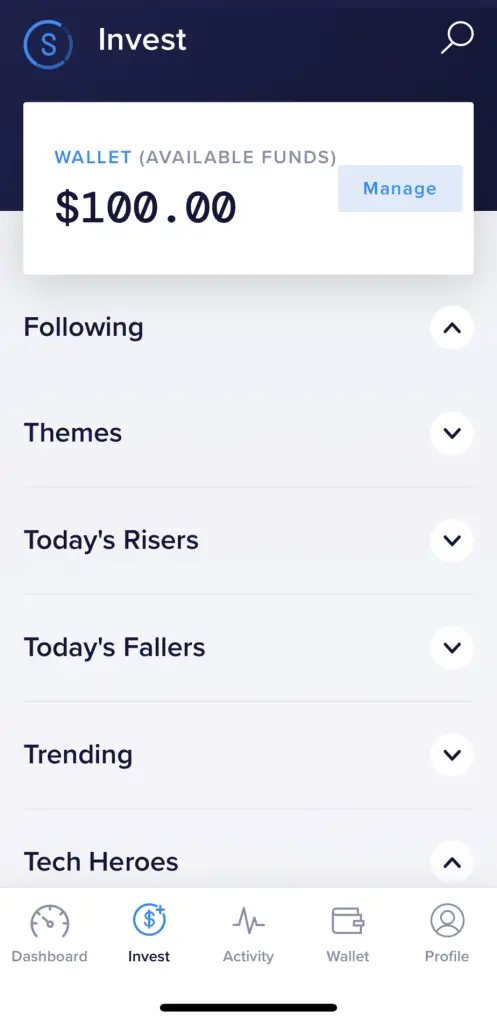

Once you’ve transferred at least $100 to your Superhero brokerage account you can look to place a trade on any of the available stocks and ETF’s listed on the ASX.

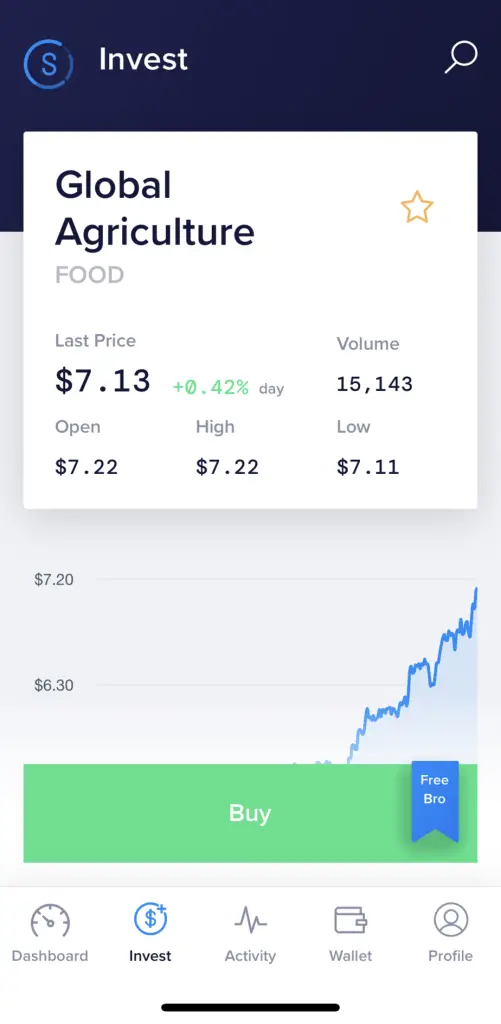

Once you’ve found an ETF or stock to trade simply click on it to bring up the stock or ETF’s details. In this example I’ll walk you through my first trade on the ETF ticker FOOD .

Upon searching for the ETF (which was a little difficult, as you can’t seem to refine the search to just the ticker symbol, you’ll see all the stocks and ETF’s with the string “food” in them – would be great if there were a way to only show tickers, should you be proficient enough to know the tickers to trade) you then select the item and are presented with the basic information you’d expect to see:

- Pricing details: last price, change (by percentage difference from close previous trading day), volume traded today, open, high, low

- Chart (1 day, 5 days, 1 month, 6 months and 1 year [default])

- Basic description

- Basic technical details (Average Volume Weighted Average Price [VWAP], Market capitalisation, P/E ratio, 52-week range, dividend yield)

- Basic market depth showing collective volume at each price variation on buy and sell side

- News

- For some ETF’s a Holdings section showing the constituents of the ETF and their weighting

But let’s see what happens when I focus on being able to place my first trade on Superhero:

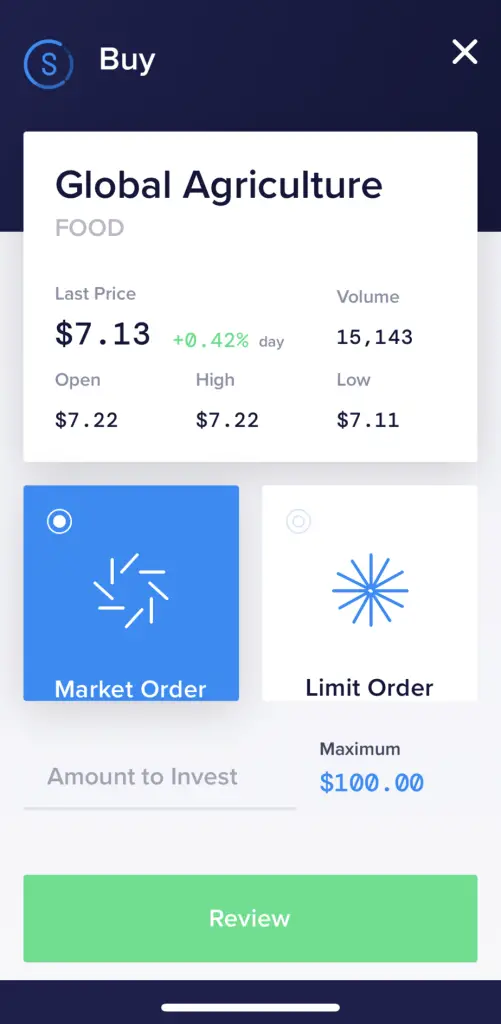

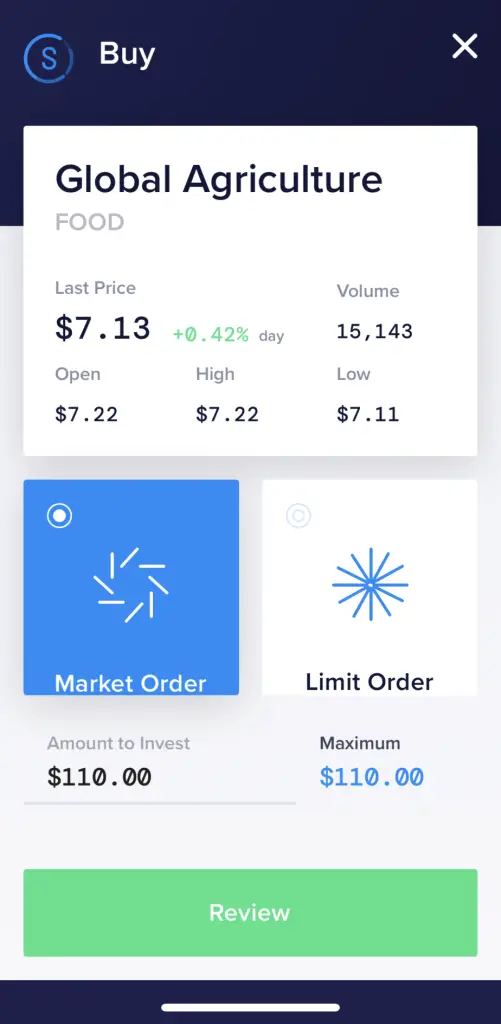

After clicking the Buy button, which has a nice Free Bro ribbon wrapped over it, you’re then presented with the next option of determining how to place your order , as shown here:

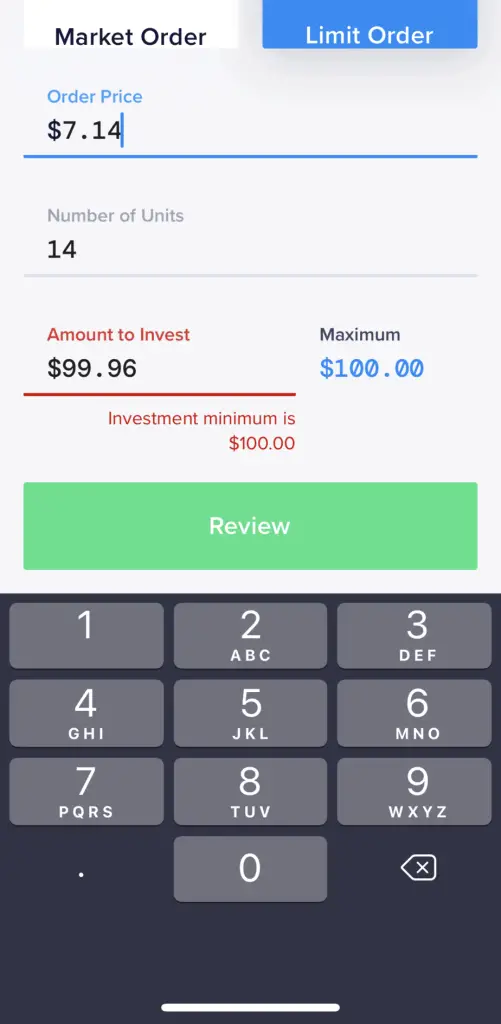

I wanted to see how strict Superhero was going to be on the $100 minimum order. As you can see my account at the time of this order was at $100, so I selected a Limit Order and entered a price of $7.14 for 14 ETF stocks ($99.96):

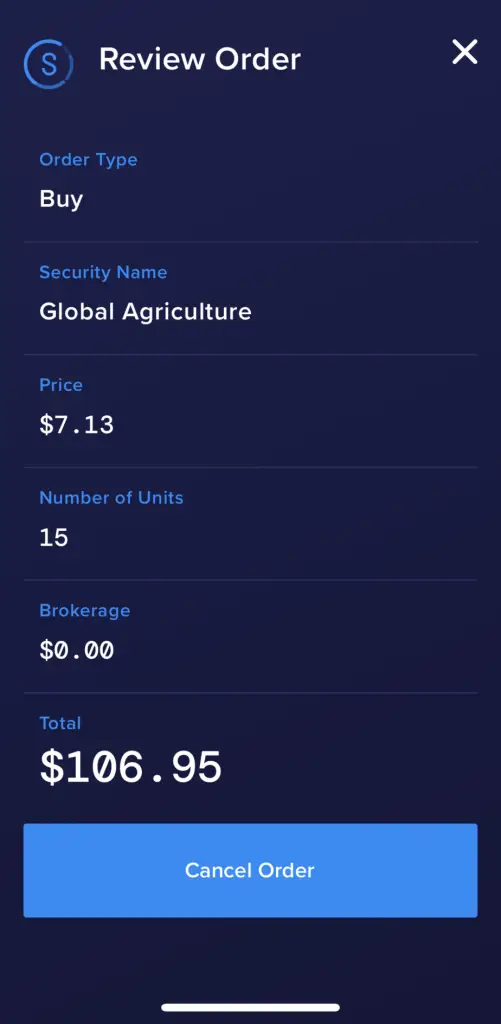

Once I added a few more dollars to the account (which I’m still so shocked at how quick it lands in the account with PayID) I was able to place my order for 15 ETF stocks, and this time I changed the price to be in the middle of the top bid and lowest ask:

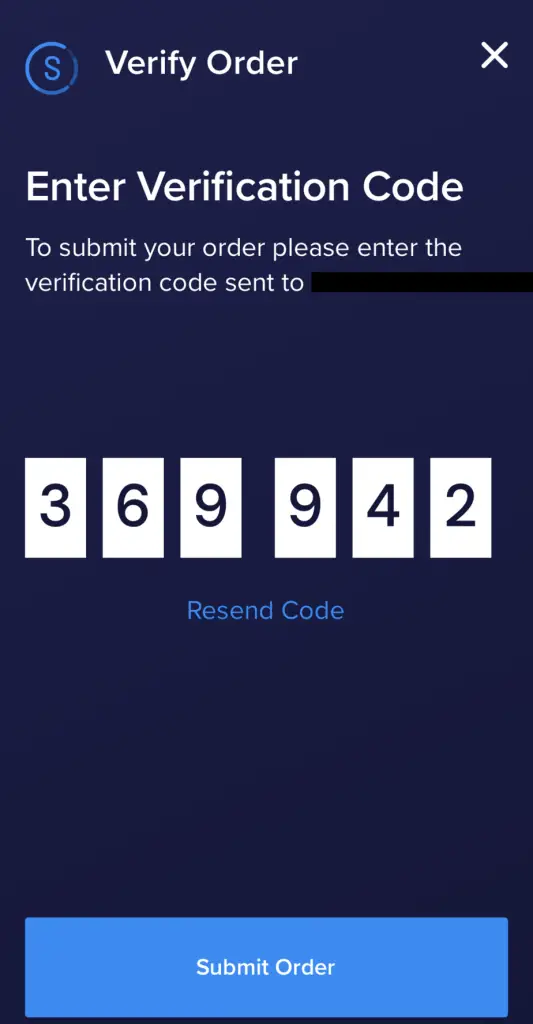

After confirming your order you then need to confirm your order with a text message which is sent to your phone to confirm (I’ve since learned that you create a Trading PIN – you’ll need to log in to the platform from the desktop browser to set this up):

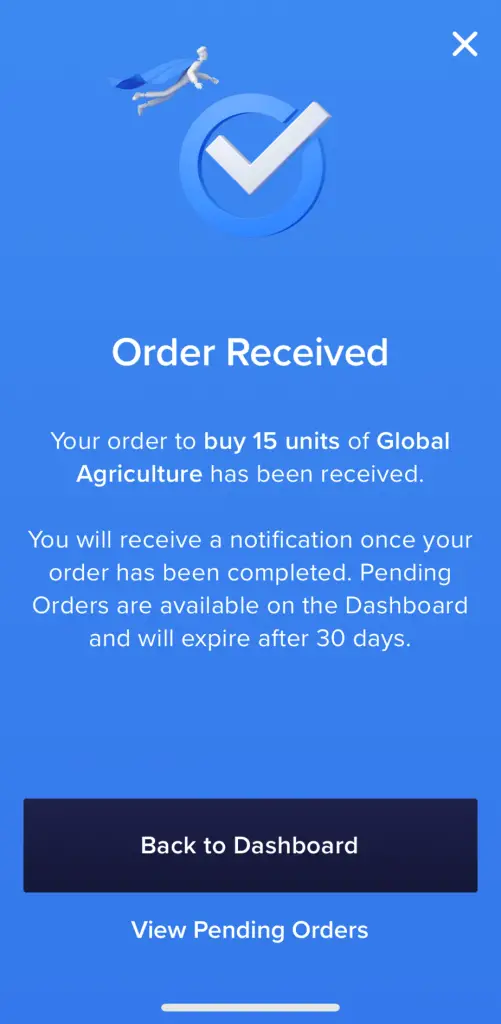

Once we have submitted our order we’re then taken to a confirmation of order placed:

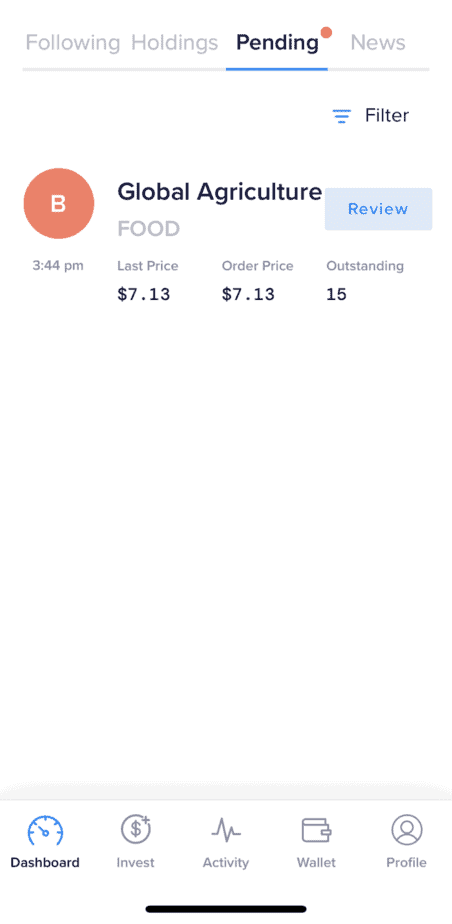

You can review your pending orders by clicking on the View Pending Orders link at the bottom of the confirmation screen above, this will show you a summary of open orders and their status:

The only option available is to review your order and cancel. There didn’t seem to be a way to amend the price or quantity of the order. So after cancelling the order as the end of the trading day neared (4pm AEST) I cancelled my order and went to place a market order.

Placing Market Order

If you want to place a market order on Superhero then the process is the same, except instead of entering a quantity of shares, you need to enter a dollar value.

To make the order quickly, I entered $110 into the order screen:

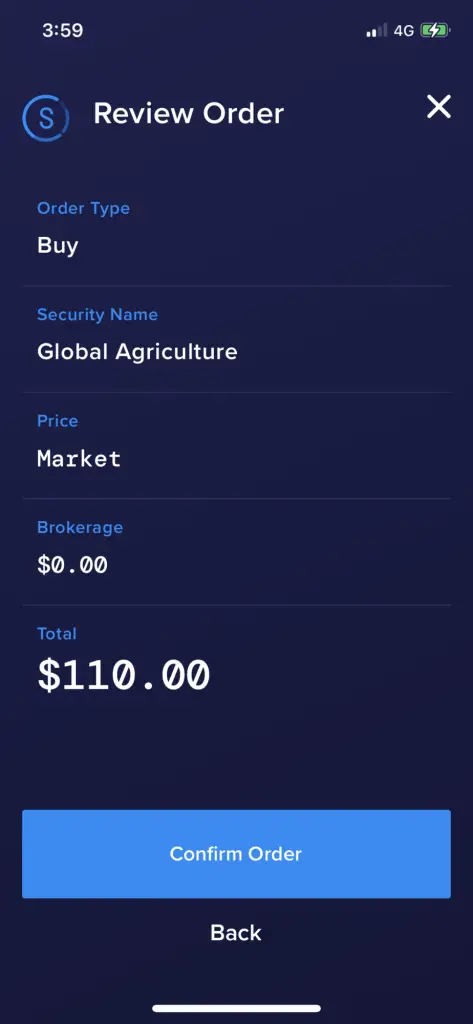

Similar to the limit order previously placed, the market order confirms your order in the same process, notice the brokerage charge of $0.00 (nice!):

Once your order is placed, and the market order is executed you will receive a text message confirming the transaction of stock you have ordered.

Concern

The only concern I have with Superhero is that any shares or ETF’s I purchase on their platform are not actually owned by me. They’re owned by Superhero.

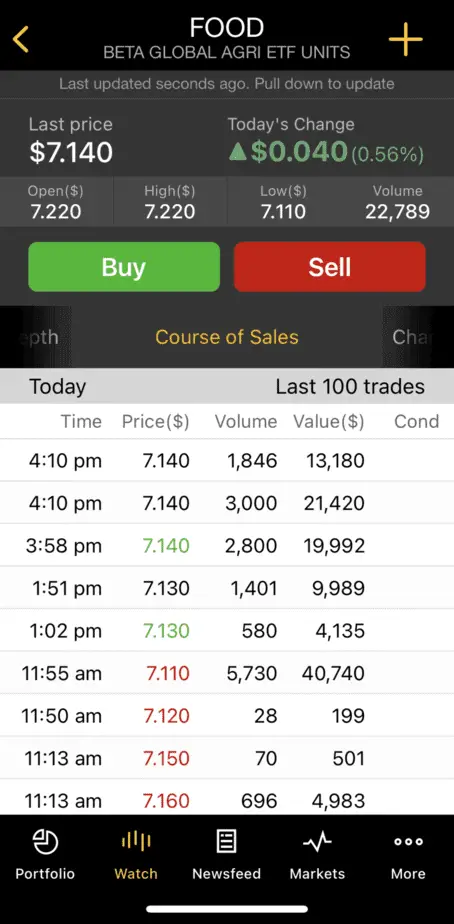

After having my order confirmed by Superhero with my FOOD ETF trade, I decided to check the Course of Sales on CommSec to see if the order for 15 stocks was placed, and here was what I found:

My order was placed at the end of the day at 3:59pm AEST, so the only trades that happened after that time were the two at 4:10pm AEST for 3,000 and 1,846.

Obviously the trade could have been bundled with order Superhero investors and could have been in any of those two amounts, but when I did place my initial limit order trade I did see a change on the market depth of 15 stocks, but when this limit order was cancelled and converted to a market order, I didn’t see those 15 shares convert to a sale in the course of sales listing.

I’m gathering more trades placed with Superhero will show whether they are placing my trades into the physical market, I’m just concerned if they aren’t how they then are making money?

Did I purchase 15 shares from a user in Superhero who was selling their stock (similar to CommSec’s Pocket cross trade)? Or is Superhero trading against me?

Anyway, I guess time will tell.

And what about ownership? Do I care if I own the shares? A little.

Conclusion

Superhero makes trading in stocks and ETF’s very easy and efficient. While the features are simple and effective enough to get into the market, for those who have come from other online brokerage platforms they may find the features somewhat lacking (for example, amending pending orders).

While there is a concern about the ownership of stocks, I’m hoping this will not become a bigger issue in time. In fact, I’m hoping if their business model succeeds well they will in time convert to a proper brokerage firm where their customers will have ownership of the stocks and ETF’s they hold on their behalf.

Overall I’m impressed with Superhero and would encourage anybody looking to get started in micro-investing (from $100) to try Superhero out.