Every once in awhile when I look at my bank account I find myself wondering the same question, “How much should I be saving every month?”. According to a few personal finance gurus (like Dave Ramsey and Scott Pape) a good target you should be aiming to save of your gross salary is around 15%.

But let’s look at how this broken down in a little more detail.

Go Annualised

It can be easy to focus on a month and think that this “normal”, but until you expand your budget to other months of the year you begin to realise that maybe the month you thought was good, was good because the other subsequent months were taking more of the expenditures.

To prevent focussing too much on any one particular month, expand to a year and then look to see how much you are saving.

Spending Percentages

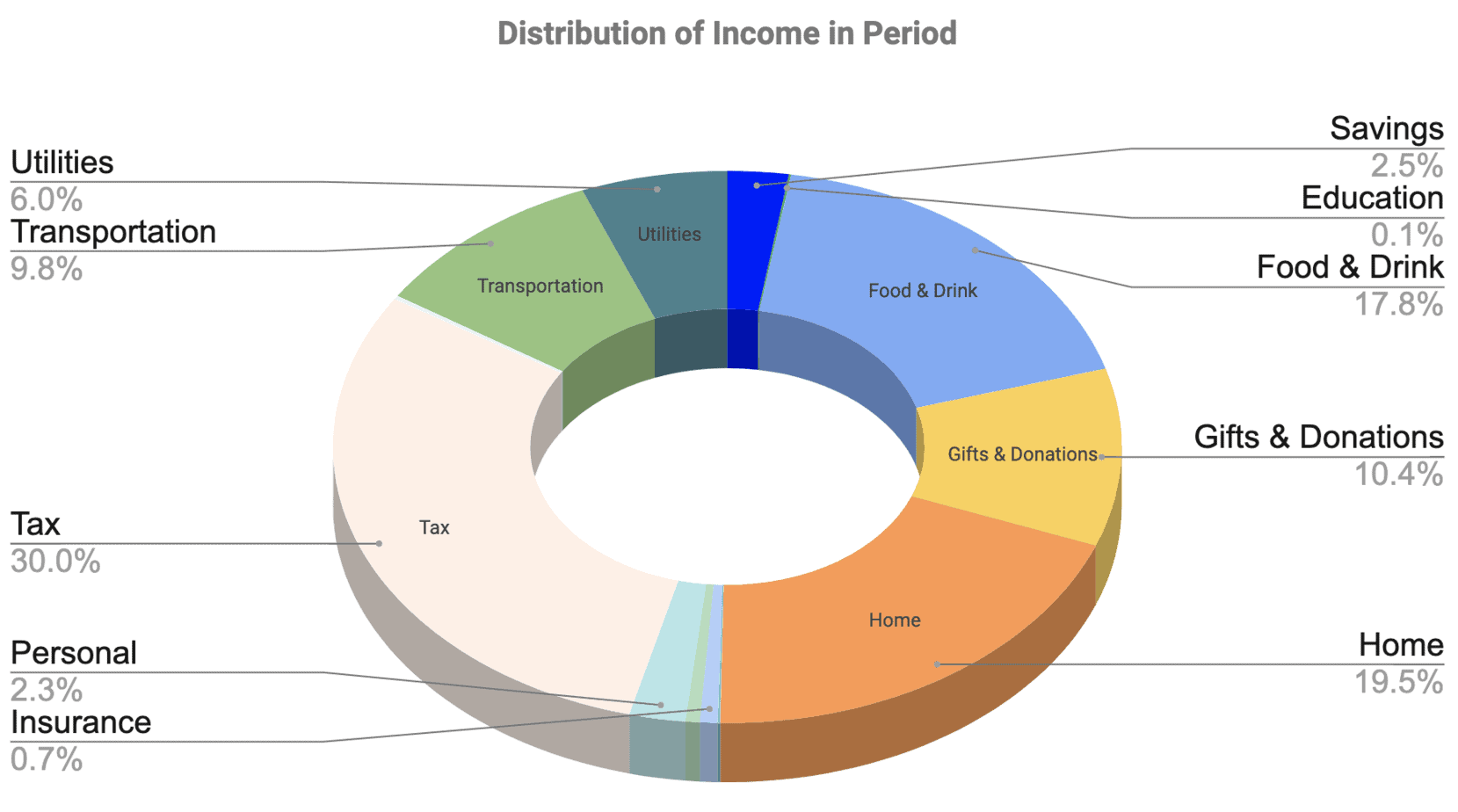

If we were to look at how our money is distributed and spent throughout the year ours would look like so:

By far our largest expense will be taxes, so finding ways to legally minimise this expense should be a priority. Then we have the mortgage, followed by private education and extra-curricular activities we have our children do (piano, math lessons, etc). I was surprised to see how much insurances take up of our income, around 5% – and this included private health cover, home & contents insurance as well as car insurances.

Hopefully if I’ve done my numbers right that should total 100%. By doing the analysis over a continuous 12 month period you will be able to average out the months where one category balloons out more than normal.

For example, school fees are generally paid at the beginning of a term and therefore that when those four months hit in the year we find our budget a little tighter than the other eight. Similarly, you might find it you do grocery shopping on Saturdays those months where you’ve got five Saturdays you’ve blown your average monthly spend.

What Expenses Decrease Over Time?

One thing we have seen over the previous decade has been a decrease in our mortgage payments. When we married and then bought our home it was back in 2011 when our interest rates were around 7.5% per annum. As we only did a variable loan we were lucky enough to reap the benefits as our home loan interest repayments continued to decline until now they’re around 3.5% per annum!

The only other category where we have seen an increase over time, albeit slowly, has been the savings category. With the birth of three children in under a span of 5 years our savings budget was acting like a bit of a yo-yo. However, if it weren’t for the increases in gross income over the decade then we wouldn’t have been seeing any real increase in the Savings category.

What Expenses Increase Over Time?

While we have savings in a couple of categories, there are a couple of categories where there has been a noticeable increase: taxes, education and groceries.

When it’s just you and your wife in your own little digs you’ll find your grocery bill really small. But then when you have children you’ll begin to see your grocery bill blow out to 4-5 times as much when it was just you two lovebirds.

So our grocery spend has continued to climb even though my wife does an amazing job in finding meals that are cheap and easy to make and also fill their little tummies.

It also shouldn’t therefore come as a shock that if you want to send your child to a private school and/or do extra-curricular activities with them to help foster and nurture their gifts and talents that this will also cost money. Out of all the three categories we mentioned here, this one will see the biggest jumps over time once all children are attending school… and don’t even mention Year 11 & 12!

Lastly, and again not surprisingly, you will notice that taxes will gradually continue to increase as you begin to earn more. This is a good problem to have, but one that will steadily climb as your salary increases.

The Steady Categories

This therefore leaves the rest which have remained somewhat steady over time, although some slightly increase due to increased consumption (such as utility bills) and inflation, but if your salary continues increase over the same period of time then you won’t really notice much of a difference to the percentage allocation of these categories.

For example, transport has been one that has ebbed and flowed over time as it depends on two main factors: fuel costs and distance travelled. Once upon a time I only lived 25 minutes away from work, but now I travel over an hour one way! The pay increase helped to compensate for the extra driving so the percentage allocation wasn’t seen as much of an impact to our family budget.

One category though that does seem to stay quite static over time has been our tithing and giving which has generally been around 10-12% every year. This again will not be noticed as your salary increases, but I guess the concept of a tithe is that it’s 10% of your gross earnings so it should be constant.

Summary

You will find throughout life that the percentage of money to save each month will vary according to your circumstances. In years where my wife was pregnant and giving birth to our children we couldn’t save much at all. However, in other years we were able to save quite well. This is why it’s extremely important that you do a personal budget to help you to see where you’ll be able to save.