One of the ways in which we can improve our personal budget is determining whether, or not we can salary sacrifice a portion of our earnings to pay for a car.

In Australia employees have the ability to pay for a car using pre-tax dollars provided the employer is happy to enter into a novated leasing arrangement. So in today’s post we’re going to look at the pros and cons of novated leasing, but before we do, let’s make sure we’re all on the same page by understanding what a novated lease is.

What is a novated lease?

To novate something is to replace one obligation with another. This means an employee will find a car they like, will arrange for a financier to pay the car dealer, but instead of the employee having the burden of lease payments, will instead “novate” the responsibility of payments to their employer and the employer will use what would have been the employee’s salary to meet those obligations.

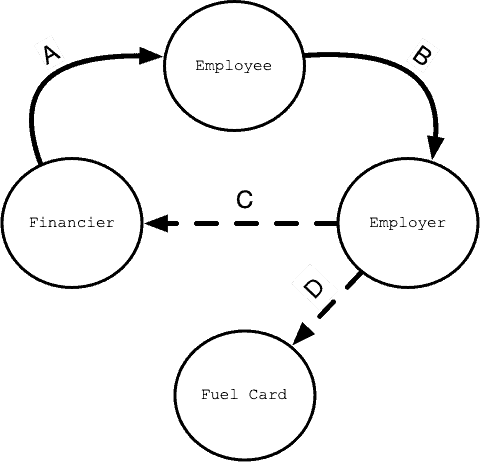

A diagram may help to show the relationship a little better, where:

- A = Represents the initial relationship between the employee and the financier.

- B = The employee novates the lease repayments to the employer agreeing to use the employee’s salary to pay for the arrangement.

- C = The employer then remits pre-tax money to the financier for the lease payments.

- D = If the relationship is a fully maintained novated lease the employer could also be remitting pre-tax dollars of the employee’s salary into a fuel card account where the running costs of the car have been expended from.

- E = The employer also withholds an amount of the likely Fringe Benefits Tax (FBT) liability that will be incurred when the FBT return has been lodged in March each year.

The car is still the property of the financier’s until such as time as the car is paid in full.

There is also no loss to the employer as they are simply replacing the expense that would have otherwise gone to the employee in the form of a salary, but instead a portion of those monies are now used to pay for the use of the car and for the running costs.

What are the benefits of a novated lease?

A novated lease arrangement can provide an employee the ability to use a new car (or second hand car if the novated company allows for it) and to pay for the car using an employee’s pre-tax earnings.

To determine the actual dollar benefit to at the end of each pay you can make use of many online novated leasing calculators which may require you to provide some personal details such as a contact phone number and email address, or you could just play with a spreadsheet and see the full results.

This is what inspired me to create my own spreadsheet. I wanted to make sure I understood as much as possible about the arrangement I was about to get into, and I poured through books and articles to try, and help me to arrive at the model to help me decide whether I was getting a benefit from this.

So instead of me just talking about it, here’s what the spreadsheet looks like to show you the benefits:

Novated Lease Pitfalls

It’s important with a novated lease arrangement that you don’t just focus on the annual benefits – which most novated leasing calculators will try to over-emphasise to you in big bold numbers, but to also consider whether this arrangement is the best option for you.

When you begin playing with the novated leasing calculator there are probably a few things you’ll notice.

- If you don’t earn enough there isn’t much of a benefit. In my testing of the current settings ($30,000 car, 3 year term, $5,282 running costs, rebatable employer) if you earned less than $31,000 there was no benefit.

- If the base value of the car is too high then there’s no benefit in novated leasing as the majority of your salary will be consumed in the pre-tax salary sacrifice. It actually works out better to buy the car outright.

Besides, the technical aspects of novated leasing, there are perhaps some deeper bigger questions to ask about the matter. In your analysis ask yourself the following questions:

- How will this arrangement affect my budget?

- Now you have an idea on what your net pay will be, have you entered these results into your personal budget to see what the impact of a reduced take home pay would cause? (Don’t forget to remove car running costs from your budget too as these will be salary sacrificed if you enter into a fully maintained lease.)

- Do I really need a new car now? Can I continue with my car a little longer?

- Cars are depreciating assets and new cars depreciate in value the most. Buying new cars is not a good investment strategy.

- What would the impact be if I just purchased the car outright from my cash savings?

That last question is one comparison you will NOT see on any novated lease calculator – at least I never did , but it is a genuine consideration, if you have the money .

Would I be better off if I just bought the car outright and paid my car running costs post tax?

As you can see from our example screenshot above you’ll be $4,813 better off for the year if you just bought the car outright with your own cash!

Missed Opportunity Cost

Now I agree to those who may state that there’s missed opportunity cost.

If you have the money, in our example the $30,000 to purchase the car, then you could have invested that into a managed fund and received a return on investment.

This means with our example that you would need to find an investment return of 5.33% p.a. or more to beat the $4,813 you’d be better off with if you bought the car outright. At the moment banks aren’t offering those interest rates in savings accounts therefore you’d need to find that return elsewhere, which means a riskier investment.

Conclusion

Whichever way you cut it being able to see the results and determine whether novated leases are the best arrangement for you now this spreadsheet will help.