An offset account is generally a transaction account whose balance reduces the loan balance. For example, if a home loan balance is currently at a balance of $300,000 and you have an offset bank account which contains a balance of $20,000 then the bank when calculating the interest charge will do so based on a loan amount of $280,000 (being the $300,000 loan remaining less the $20,000).

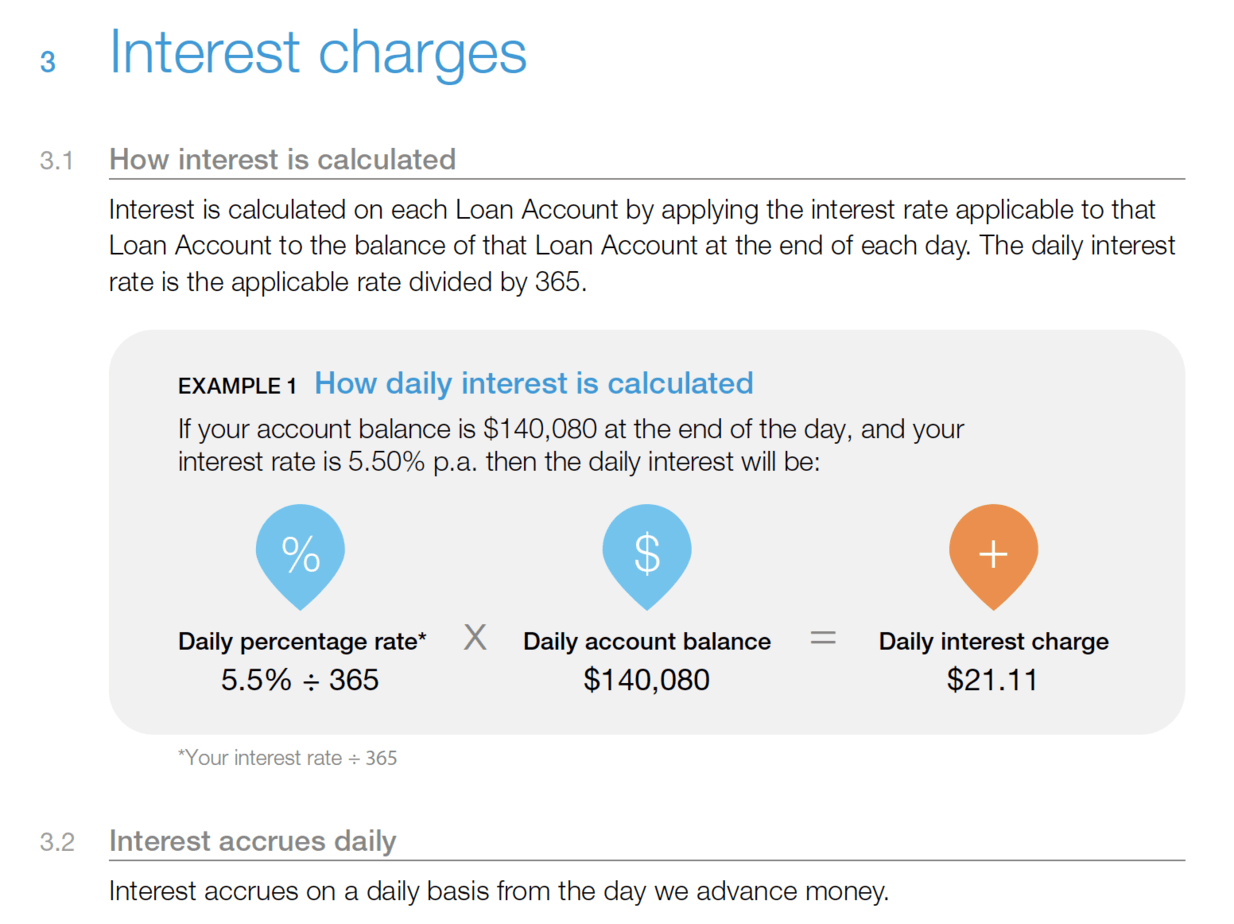

To check how interest is calculated check your home loan terms and conditions document and find the interest section.

With my current home loan at Macquarie Bank the Interest section in terms and conditions document has the following:

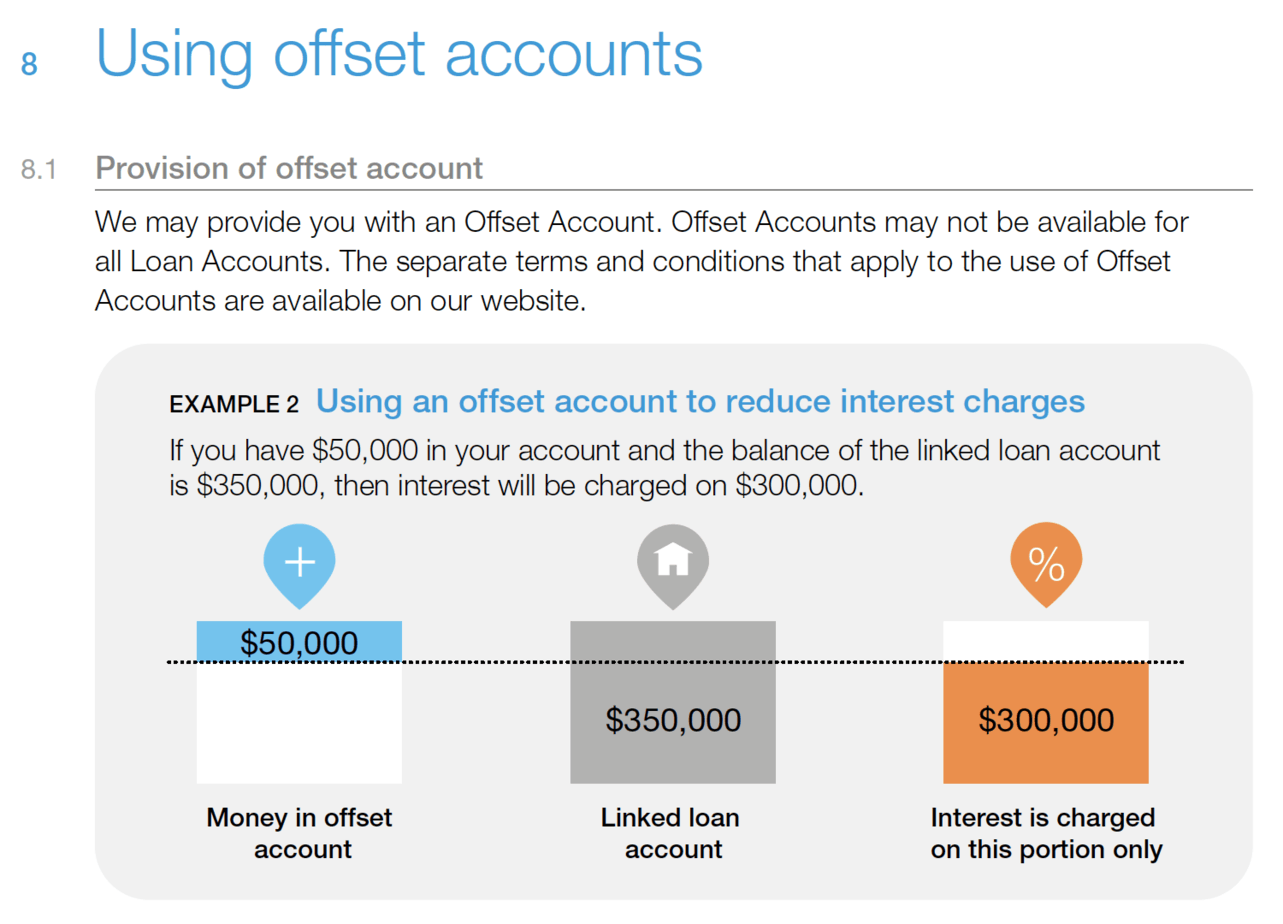

If you have an offset arrangement with your lender then you’ll want to find in the same Terms & Conditions document regarding your home loan the way in which the offset accounts are applied to home loan.

Once again Macquarie has been quite instructive and has helped to provide a diagram illustrating how the offset arrangement works:

Therefore, because the offset accounts reduce the loan balance liability and this is needed when calculating the daily interest charge of your repayment then YES your monthly repayment will fluctuate depending upon the amount in your offset bank accounts.

However, this only applies if you have a variable interest rate home loan. Fixed rates generally do NOT permit offset facilities to reduce the loan liability.

Conclusion

To help reduce the interest charged against your home loan liability look for lenders that allow you to apply one or more offset bank accounts. Macquarie Bank allows up to 10 offset bank accounts, which works well for us as we have 2 transaction accounts – one main joint account and one account for my wife due to the nature of payment for the associate lease arrangements.

By having an offset bank account you can further reduce your interest charge over the life of the loan, which, if placing those funds as extra repayments back into the home loan, will help you pay off your home loan sooner.

If you don’t have an offset facility against your home loan lender then ask them if they can provide this, it may mean changing a few things, but it is worth it. If they don’t then shop around for a more flexible mortgage.